- Summary:

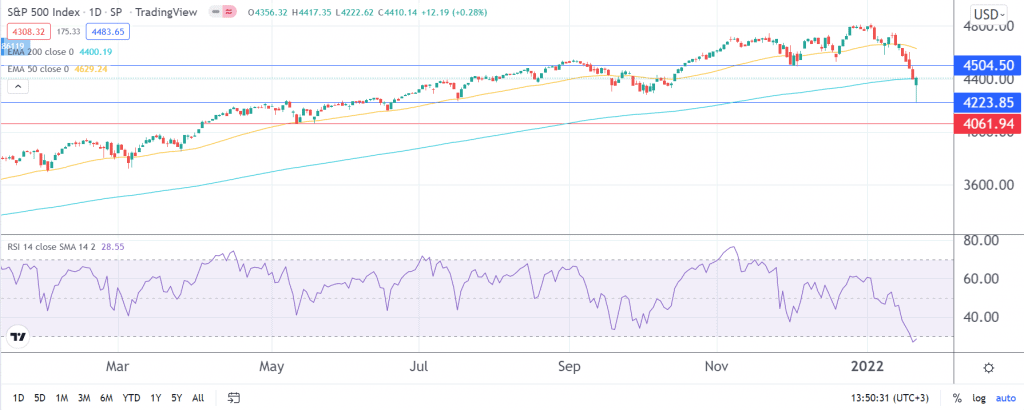

- S&P 500 has dropped past the 200-day EMA for the first time since the start of the coronavirus pandemic in April 2020.

S&P 500 remains under pressure as markets shift their focus to January’s Fed meeting. Over the past 7 sessions, it has been in the red for five sessions; dropping by 7.16%. Over the same timeframe, Dow Jones and Nasdaq has plunged by 5.76% and 9.38% respectively.

Earlier in Tuesday’s session, S&P 500 extended its previous losses to a 7-month low at $4,223.85. While it has since bounced back to the current $4,410.14, it is still on a downtrend.

Since the beginning of the year, the index has dropped by 8.50%. The plunge has been the largest in over nine decades. Granted, in previous years – particularly in 2009 -, there have been faster drawdowns. However, the rebounds have often been quicker.

Investors’ focus is on the US central bank in its efforts to tighten the monetary policy. The subsequent rise in Treasury yields has been weighing on the stock market. At the time of writing, the benchmark 10-year bond yields were at 1.78% after bouncing off Monday’s low of 1.70%. Despite the recent pullback, the bond yields have remained on an uptrend for over a month now; hitting a high of 1.90% in the past week.

An environment of higher interest rates, coupled with the heightened inflationary pressures and ongoing geopoliticial tensions will likely continue to weigh on the stock market. Besides, after the historic 20-month rallying, the index will likely continue on downward momentum in the short term.

S&P 500 technical outlook

On a daily chart, the index has dropped below the long-term 200-day EMA for the first time since the onset of the coronavirus pandemic in April 2020. It is also below the 50-day EMA. Besides, following its plunge earlier on Tuesday, it is in the oversold territory with an RSI of 28.

Based on both the technical indicators and the fundamentals, S&P 500 may record further losses in the ensuing sessions. In the immediate term, it may hover around the 200-day EMA at 4,400. It may rebound further to 4,504.50 before pulling back.

On the lower side, the bears will have an opportunity to retest the day’s low at 4,223.85. Past that level, the next target will be at May 2021’s low of 4,061.94.