- Summary:

- The latest partnership between Solana Ventures, Forte and Griffin partners could boost bullish Solana price predictions for 2022.

Solana has recorded modest gains for the 2nd day after partnering with Forte and Griffin Gaming Partners to develop the gaming component of Solana’s ecosystem. This partnership is geared towards transforming Solana into a GameFi hub, but will this be enough to boost Solana price predictions to the upside?

The crypto market has endured a steep correction, and Solana has borne its own share of the brunt after hitting its all-time highs in November. However, with 2022 set to be the year of the Metaverse tokens, this funding initiative could be one that accumulators looking for bargain prices on the SOL/USDT pair can build on.

In November, Solana Ventures had launched a $100m fund in partnership with FTX and Lightspeed Venture Partners to mark its entry into the gaming finance space. $150m will be set aside to invest in the network’s game development. Solana’s 65,000 transactions-per-second speed puts it in good stead to sustain play-to-earn games.

Investors appear to be pleased with the developments, and the SOL/USDT pair attracted some demand from the news. The SOL/USDT pair is up 1.68% as of writing.

Solana Price Prediction

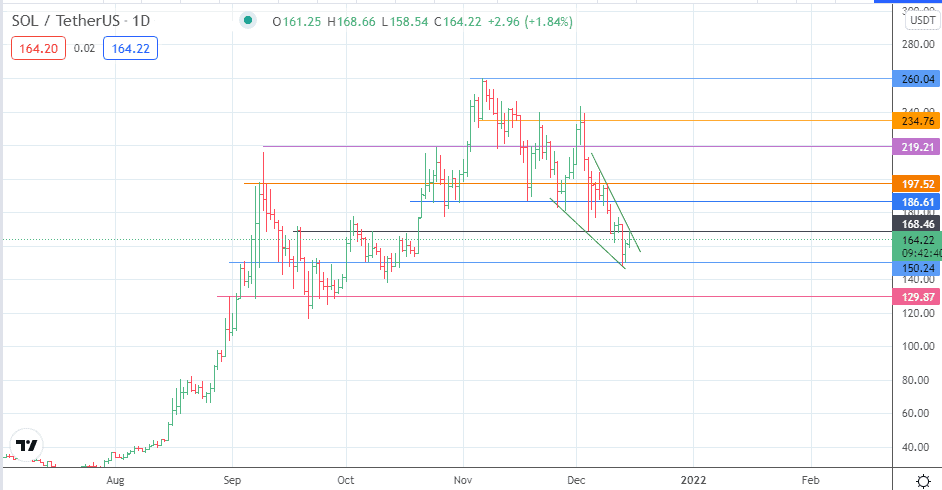

The daily chart shows a falling wedge in evolution. The active daily candle is testing the wedge’s upper edge, located at the 168.46 resistance mark (18 September, 8/17 October highs). A break of this level confirms the pattern and opens the door for a measured move towards the 197.52 barrier. This price level would mark the completion point of the price objective from the pattern and 186.61 must be uncapped for this level to be attained.

On the other hand, rejection at 168.46 leads to a pullback which targets 150.24. If the bulls leave this support unprotected, a decline towards 12.87 would be the next logical move. This movement would invalidate the wedge pattern.

SOL/USDT: Daily Chart

Follow Eno on Twitter.