- The Solana price is having a good day. SOL is trading at $181, which is just about 16% below the all-time high.

The Solana price is having a good day. SOL is trading at $181, which is just about 16% below the all-time high. This price is also about 56% above its lowest level in September. This rebound brings its total market capitalization to more than $55 billion, making it the 6th biggest cryptocurrency in the world.

SOL crypto bounces bank

Solana is a blockchain project that has become relatively popular these days. The platform is beloved by all types of developers who are building decentralized applications. The ecosystem is made up of developers building DeFi, non-fungible tokens (NFT), metaplex and other applications.

Some of the top platforms built on Solana are 1Sol, 8Pay, Serum, and Anchor Protocol. According to DeFi Llama, Solana has about 26 DeFi applications that have a total value locked (TVL) of more than $12 billion. The biggest DeFi apps in the ecosystem are Raydium, Saber, and Sunny. In Solana’s website, it identifies about 116 applications.

Solana has also been widely used by Circle’s USDC. About $2.1 billion USDCs have been issued on Solana’s network. The average issuances is usually about $50 million. Audius and FTX are other platforms that are currently using Solana’s technology.

So, what next for the Solana price? It is unclear why its price has jumped sharply in the past 24 hours. It could be because of the overall trend in the blockchain industry where the price of Bitcoin soared to an all-time high.

Solana price prediction

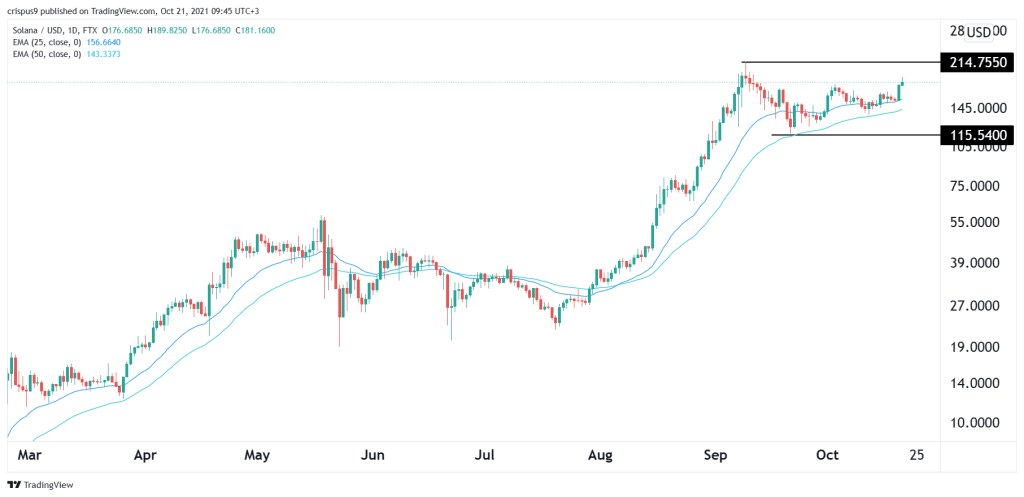

The daily chart shows that the Solana price has been in a relatively narrow range in the past few weeks. The coin has remained between the important support and resistance levels at $115 and $214. It has also moved slightly above the 25-day and 50-day moving averages. This consolidation could be viewed as a bullish flag pattern.

Therefore, there is a likelihood that the coin will bounce back higher as interest in cryptocurrencies resume. If this happens, the SOL price could move comfortably above $200 and the important resistance level at $215. This view will be invalidated if it moves below the support at $115.