- Summary:

- SoFi stock price is facing headwinds from the high interest rates. The increasing cost of borrowing is affecting the fintech firm's revenue.

The stock of SoFi Technologies (NASDAQ: SoFi) is in turmoil as it has crashed to fresh new 3-month lows. This was due to the FOMC statement pointing towards another potential rate hike later this year. The stock of the fintech firm is changing hands at $7.75, down 2.5% till press time.

SoFi’s reliance on interest rates is considerably more than that of a traditional bank. It is a fintech company that relies on lending and borrowing activities to stay in business. On Wednesday, the US FED vowed to keep interest rates elevated in the future. This will mean higher borrowing costs for SoFi’s customers, decreasing profits. As a result, its stock plunged 15% during this week.

BOA Analyst Calls SoFi A Buy

The Bank of America analyst, Mihir Bhatia, expects SoFi to benefit from the resumption of student loans as it already holds a strong position in that market. The fintech company’s market share has risen to a massive 60% in recent quarters.

SoFi announced $77 million as their EBITDA for the Q2 of 2023. Analysts expect a 24.4% rise in revenue for 2024. SoFi also added 584,000 new members, which increased their total members to 6.2 million. This number of members is 6 times more than in the first quarter of 2020. SoFi stock price is trading at $7.56 in the final hour of the Friday’s session.

SoFi Stock Price Falls Back Into The Range

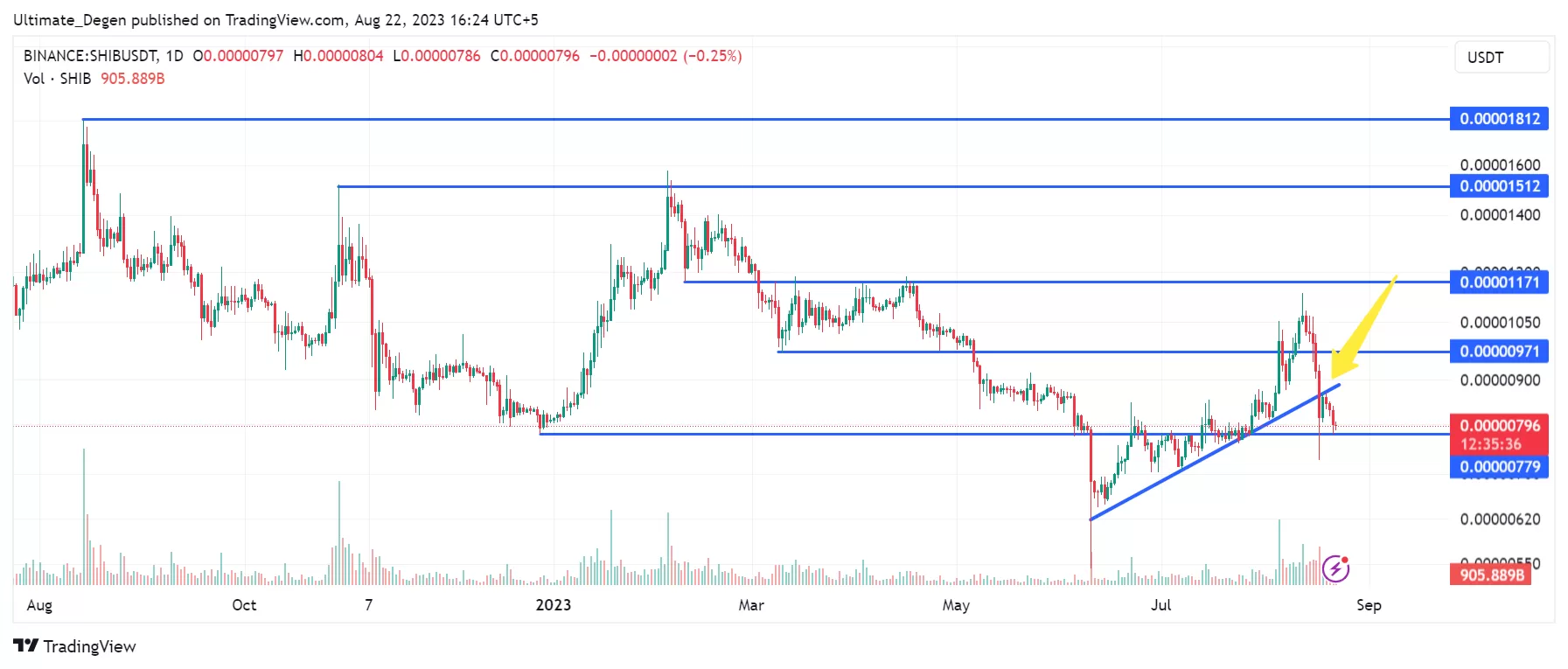

An analysis of the daily chart reveals that the stock has been trading within the $4.8-$8.1 trading range since April 2022. Earlier this year, the NASDAQ: SOFI broke above the range highs and was also able to flip it into a strong support level. However, after a rejection from the 11.7 level, the shares are once again retesting the previous range high.

If SoFi stock price gains acceptance below the range high of $8.1, I expect a 17% correction to retest the middle of the trading range, which lies at $6.45. On the other hand, the stock price prediction will flip bullish if it gains strength above $8.1 in the coming days.

In the meantime, I’ll keep sharing updated my personal trades on my Twitter, where you are welcome to follow me.