- Summary:

- Silver price rallied for the fourth straight day as focus shifted to the upcoming US inflation data and interest rate decision by the Fed

Silver price rallied for the fourth straight day as focus shifted to the upcoming US inflation data and interest rate decision by the Federal Reserve. XAG/USD price rose to a high of 19, which was higher than this month’s low of 17.60. Other precious metals like gold, platinum, and palladium have also had a strong recovery.

US inflation data ahead

Silver has had a difficult performance this year amid rising fears of a recession. As an industrial metal, silver usually does well in a period when the economy is flourishing. And recent economic data from key countries like China, the United States, and Europe show that their economies are struggling. This could impact silver demand. At the same time, more mining companies like Fresnillo are boosting their mining activity.

The next key catalyst for the silver price will be the upcoming US inflation data. Analysts expect the data to show that the headline consumer inflation dropped sharply in August as the cost of gasoline fell. Still, analysts believe that the Fed will maintain a more hawkish tone even when inflation slips.

However, a drop in inflation will signal that the Fed will start slowing its interest rates earlier than expected. Silver price has also rebounded as the US dollar index (DXY) retreated. The index slipped to a low of $108.20, which was lower than this month’s high of over $110.50.

Silver price forecast

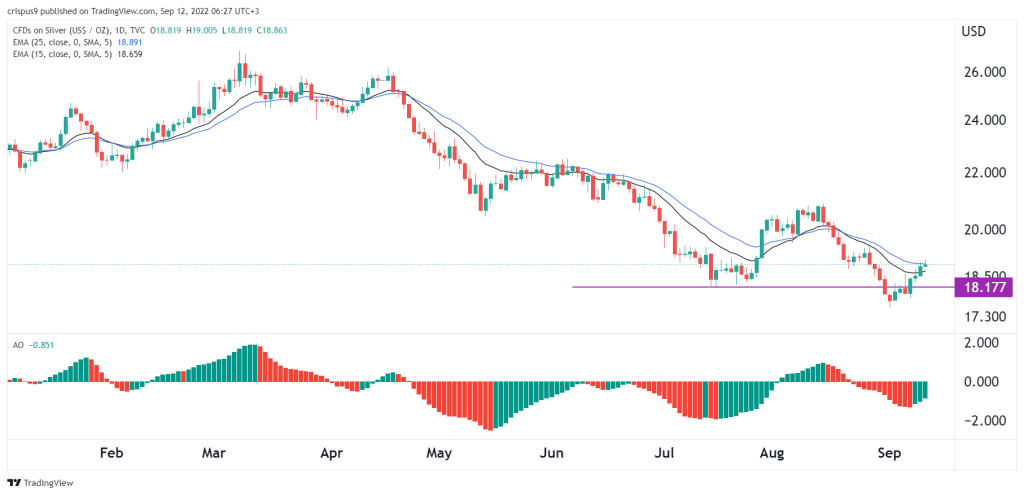

The daily chart shows that the XAG/USD price has been in a strong comeback in the past few days. It has managed to move above the important resistance level at $18.17, which was the lowest level on July 14. The metal is trading at the 25-day and 50-day moving average while the histogram of the Awesome Oscillator has formed a green colour.

Therefore, the outlook for silver price is currently bullish, with the next key resistance level to watch at $20. A drop below the support at $18.7 will invalidate the bullish view.

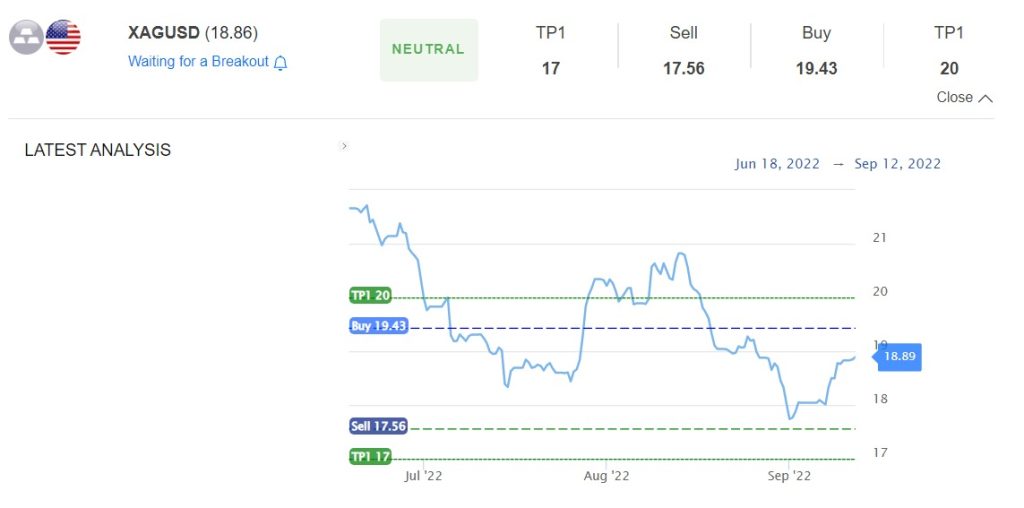

XAG/USD support and resistance level

Meanwhile, according to InvestingCube’s S&R indicator, the outlook of silver prices is neutral. A bullish view will see the coin jump to $19.43. The alternative scenario is where silver prices drop to $17.