- Summary:

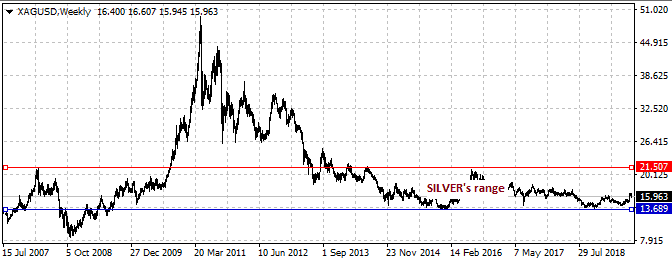

- Silver (XAGUSD) is now trading close to the lower end of the long-term range, after losing ground to the US Dollar following yesterday's FOMC rate cut.

Silver is sharply lower today after the FOMC decision which cut interest rates, but has left traders divided over whether further cuts will be coming this year or not. The XAGUSD pair is trading at 15.964 and is presently testing the S2 daily pivot. The price fall also follows that of gold, which retreated against the dollar as the greenback gained broadly following the Fed decision.

Possible Trade Setups for XAGUSD

Having made an intraday high of 16.28, which was close to where silver had found support for the past one week at 16.33, silver has pushed lower and broken the S1 pivot in the process. A breach of intraday support presently being seen at 15.96 will open the door for a test of the S3 pivot at 15.73. Further support is seen at 15.52.

If the intraday support holds firm, then there may be a price recovery to the next resistance level at 16.10. Other resistance levels above include the 16.33 (previous lows of July 25 to July 28) and 16.48 price levels.

The intraday bias for silver continues to remain bearish as the US Dollar is expected to continue gaining ground in the coming hours. However, XAGUSD is still technically speaking in a long term consolidation, and the present bearish move is actually a leg down from the upper end of the consolidative range that extends from 14.02 to 21.50.

Don’t miss a beat! Follow us on Twitter.