- Summary:

- Silver prices took a step higher towards achieving the $17 mark as demand for metal commodities pushes sends XAGUSD soaring.

Silver is extending higher today even as an ounce of gold is approaching the $1500 level. XAGUSD is presently trading at $16.87, after bouncing on the $16.17 weekly support line that has held firm in the last three weeks.

The bias for silver remains bullish at the moment as a safe haven sentiment continues to dominate the market in a week that is relatively thin when it comes to market moving news from Europe and the US.

Technical Plays for Silver

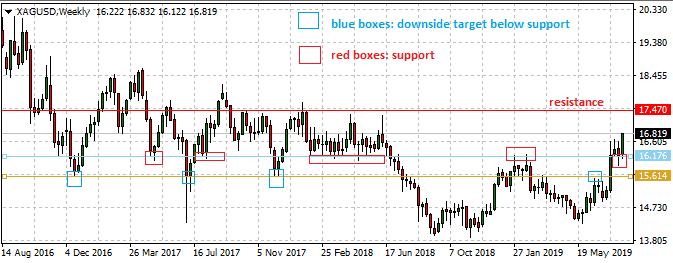

The weekly chart shows the support and resistance areas that need to be watched closely. The $16.81 price level will act as a weekly resistance area, as this is site where price found resistance for several weeks in the first half of 2018. This is the key resistance level to be tested first. An upside break of the $16.81 resistance will open the door for further resistance tests at $17.47.

On the flip side, silver will find support at the $16.17 and $15.61 price levels in the medium to long term. A short term support level is also seen at $15.80. There must be a downside breach of the $16.17 support area for price to attain these levels.

Long term traders should note that silver is still in a consolidation which extends from the $13.76 to $20.93 price levels, depending on broker pricing. Therefore this present bullish move is actually a push to the upper end of the range in the long term context.