- The Shell share price has an upside potential of 22.27%, according to the latest recommendations of institutional analysts.

The Shell share price (formerly Royal Dutch Shell share price) has had a roller-coaster ride following the onset of the COVID-19 pandemic, the intervention of the OPEC+ alliance and the supply constraints created by the sanctions on Russia’s oil following the invasion of Ukraine. As an energy company, the Shell share price has followed the same trajectory as crude oil prices on the Brent benchmark in the last couple of years.

Shell Share Price: Recent History

The onset of the COVID-19 pandemic dried up demand for crude oil as the manufacturing and transportation sectors were shut down to contain the spread of the pandemic. The situation led to a glut in crude oil supply with virtually zero demand, leading to a collapse of oil prices to negative levels in April 2020. The Shell share price followed suit, dropping from a pre-pandemic high of 2342.6 on 3 January 2020 to 889.8 on 19 March 2020.

The situation forced the Organization of Petroleum Exporting Countries (OPEC) and its allies led by Russia (collectively called OPEC+) to cut the production quota for each member country, with stringent conditions for the regulated lifting of production limits every month. OPEC’s action helped shore up oil prices to the $80 mark by the end of 2021. However, a new fundamental trigger arrived in 2022, with the Russian invasion of Ukraine on 24 February. The situation has led to the sanctioning of oil exports from Russia.

Russia contributes 8% of the total crude oil global supply. With Russia’s oil off the market, along with that of sanctioned Iran and war-torn Libya, a significant supply constraint has worsened the energy crisis that emerged in late 2021 due to overwhelmed supply chain components.

The attendant rise in energy prices has been good for oil companies such as Shell. The Shell share price has recovered from its March and November 2020 lows and is pushing towards the highs seen in the month before the pandemic struck.

Latest Shell Share Price News

In January, shareholders approved merging the share listing of the A and B shares of Royal Dutch Shell on the London Stock Exchange and a redesignation of the stock’s symbol to a common one known as SHEL. This followed a decision to move its corporate headquarters from the Netherlands to the United Kingdom, dropping “Royal Dutch” from its name. The company is now known as Shell Plc.

Shell Share Price Outlook

The stock’s recent price action has been topsy-turvy and follows the recent volatility in energy prices. Ten brokerages have provided a 12-month forecast for the Shell share price. They all have BUY recommendations and a 12-month price target of 2326.40. This gives the stock a 22.27% upside potential within the next 12 months.

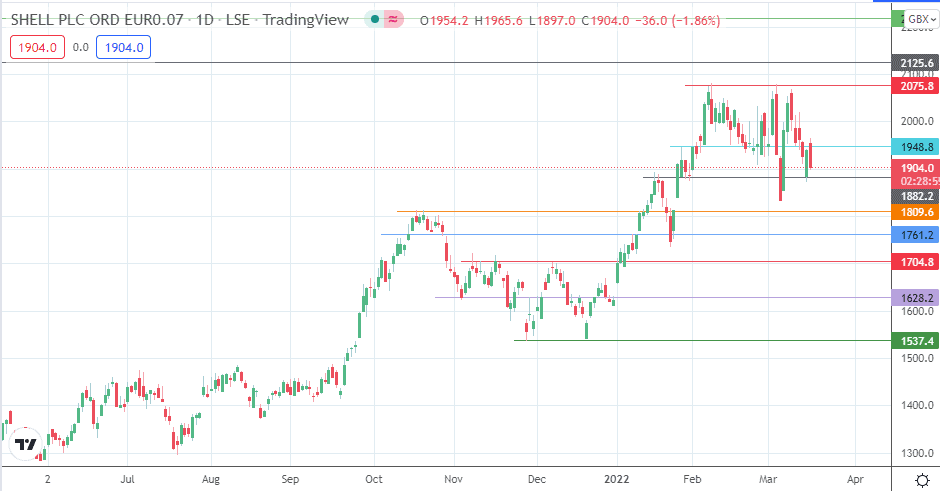

The 1.27% downward move on Wednesday follows the rejection of the upside move of 15 March at the 1948.8 resistance level. This sets the price candles towards the 1882.2 support level. A breakdown of this support must also clear the low of the 4 March candle at 1833.4 before 1809.6 is attained. If the bulls fail to defend this new pivot, we could see a slide towards 1761.2 (27 October 2021 and 25 January 2022 lows). 1704.8 is an additional downside target that is presently out of reach but becomes viable if 1761.2 is broken.

On the flip side, the uptrend in the Shell share price could continue if the bulls can uncap the 1948.8 resistance and the 2075.8 barrier. This scenario will see the 5 December 2019 and 29 January 2020 lows at 2125.6 coming into the picture as the next upside target, followed by the 1 November 2019 low/24 January 2020 high at 2217.8.

Shell: Daily Chart

Follow Eno on Twitter.