- Summary:

- The Royal Dutch Shell share price bullish momentum is continuing as the price of crude oil and natural gas rises.

The Royal Dutch Shell share price bullish momentum is continuing as the price of crude oil and natural gas rises. The RDSB share price is trading at 1,800p, which is the highest level it has been since February 2020.

RDSB strong recovery

Shell shares have staged a major recovery in the past few weeks. The stock has risen by more than 123% from its lowest level in November last year. This performance has been driven by the strong performance of crude oil prices.

In the past few months, the prices of crude oil has jumped to a seven-year high while that of natural gas has risen to an all-time high. Now, because of the supply and demand imbalance, there is a possibility that the prices will keep rising.

This will benefit both revenue and profitability of Shell, one of the biggest oil and gas producers. The price will also help to offset the losses due to Hurricane Ida. At the same time, the decision to sell its American assets to ConocoPhilips will lead to better returns.

The Shell share price is also rising today after the company said that it will start developing gas fields in Trinidad and Tobago. Its production is expected to start as early as in 2025. The fields have more than 2.1 trillion cf.

Shell share price prediction

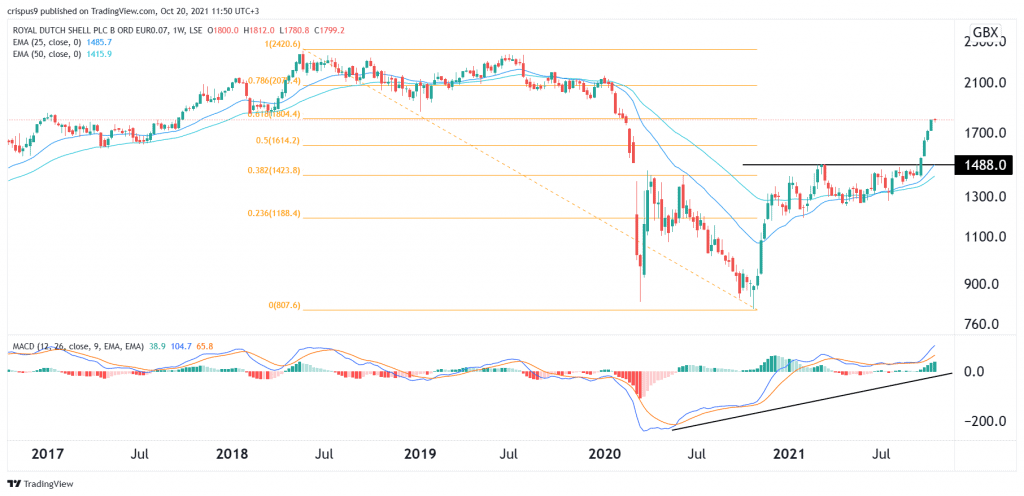

The weekly chart shows that the RDSB share price has been supercharged recently. The stock managed to move above the key resistance level at 1,488p, where it struggled to move above several times before. The shares have also risen above the 25-day and 50-day moving averages. Notably, they are along the 61.8% Fibonacci retracement level. The MACD has been in a bullish trend as well.

Therefore, while a short pullback is likely, the overall view is bullish. The next key resistance level to watch is the 78.6% retracement level at 2,075p. On the flip side, a drop below the 50% retracement level at 1,615p will invalidate the bullish view.