- Palantir stock rose 138% in 2025 but concerns over valuation bring new challenges that could tame investor appetite

- The company's Artificial Intelligence Platform continues to be its biggest earnings source

- Palantir will release its earnings report in early February and that could define the stock's performance in the early part of the year

Palantir (NASDAQ: PLTR) has retreated from its run toward $190, currently testing the $170 support level as of mid-January 2026. After its gains in 2025, the question is whether this AI stock is coming back down. After a rise of 138% in 2025, some profit-taking makes sense. However, this dip also makes us wonder if a bigger correction is starting, especially as the next earnings report gets closer.

Can PLTR Price Repeat 2025 Heroics?

It’s going to be hard to repeat a triple-digit performance. Analysts at Barchart and Nasdaq think that while 2026 looks good, it might be a year of digestion. Revenue for 2025 is expected to be around $4.4 billion, and 2026 is projected to climb to about $4.8 billion to $5.4 billion. The AI Platform (AIP) drove strong growth, with U.S. commercial growth at 121% late last year. But the surprise that boosted the stock in 2025 is now priced in.

Is Palantir Stock Overpriced?

When we look at the numbers, Palantir remains one of the most expensive names in software. Its Price-to-Sales (P/S) ratio has recently hovered around 113x, a figure that dwarfs competitors like Salesforce (6.1x) and SAP (6.6x).

Also, the stock’s forward P/E is near 260, which doesn’t leave much room for error compared to peers averaging under 50. This could mean it’s overvalued, potentially leading to a correction if growth slows down. Palantir’s platforms, like AIP, are still attracting clients, but it will be hard to see big gains from here. If the economy slows down, as Forbes suggests, it’s even less likely that it will repeat its 2025 performance.

Do Palantir’s special government deals and AI advantages justify the excitement? Maybe, but the market cap suggests everything must go right, which isn’t realistic. Investors should think carefully about these things, especially with earnings coming up. A bad report could cause a big price drop. Conversely, if Palantir beats expectations, the stock might hold steady, but doing as well as in 2025 will take perfect results.

Palantir Stock Prediction

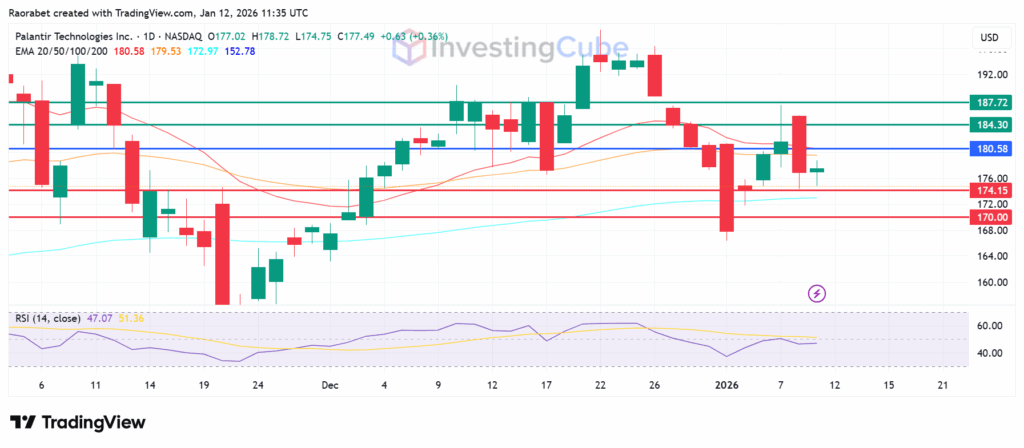

Palantir is currently in a high-stakes tug-of-war. After failing to break through the $190 resistance, the stock has fallen back to a key support zone between $170 and $174. If it goes below $170, it could fall to the 100-day moving average near $163. The upside has immediate resistance at the 20-day EMA at $180, and action beyond that level could bring the next barrier at $184.30. If the stock breaks past that level, the next resistance will likely be at $187.72.

Palantir stock daily chart with key support and resistance levels on January 12, 2026. Created on TradingView

The drop likely happened because investors took profits at the start of the year to delay paying capital gains taxes. Also, the market shifted from software to semiconductor stocks, and there were worries about Palantir’s valuation before the February earnings report, which put pressure on the stock.

Yes, judging by standard metrics. Palantir’s price-to-sales ratio is over 110, which is much higher than Salesforce and SAP, which are below 7. Investors are paying extra for Palantir’s special AI features instead of what it currently earns.

Investors should focus on the growth of the Artificial Intelligence Platform (AIP) and whether the company can maintain its 60%+ revenue growth. If the company’s guidance predicts slower growth in commercial deals, the stock price could drop even more.