- Tesla stock is down by more than 10% in 2026 and is on the brink of breaking below the psychological $400 mark

- Dwindling sales, the end of EV credits and increased physical AI expenditure present a significant challenge

- The company's energy storage segment is not only growing fast but also has impressively high margins and could help in the stock's rebound

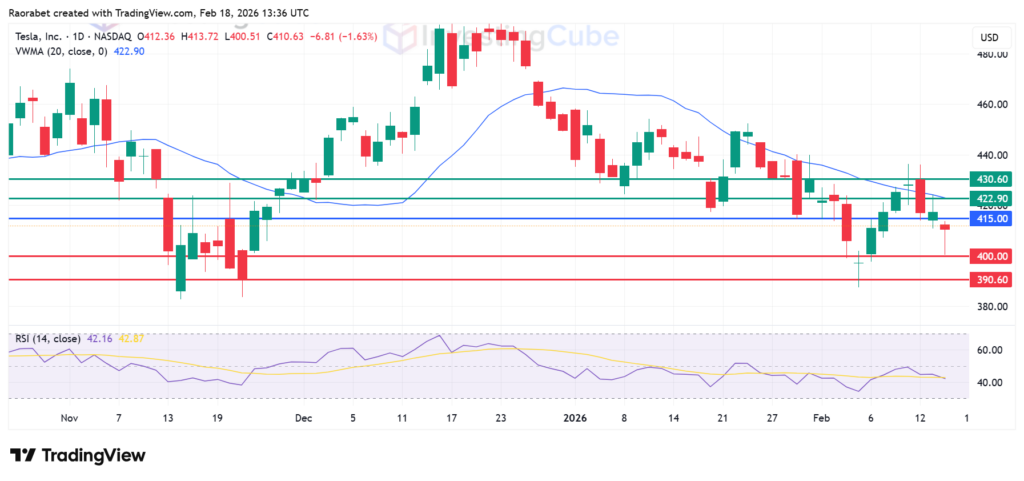

Tesla stock (NASDAQ: TSLA) has had a rough start in 2026, dropping over 10% since January and trading around $415 as of February 18, 2026. This is quite a change from its late 2025 performance when it almost hit $490. Many investors are now wondering if the company’s high stock price is justified. So, is the EV king losing its crown?

Why Tesla Stock Is Declining

The current decline in Tesla stock price can be traced to lower-than-expected vehicle deliveries and shrinking profit margins. In the fourth quarter of 2025, Tesla delivered about 418,000 vehicles, which was below expectations. The company’s Q4 2025 update also showed this is the second year in a row that annual deliveries have decreased.

This trend has continued into early 2026, with January sales data showing further weakness in important markets such as Europe and China. This is due to increased competition from BYD and traditional car companies. Also, the end of some EV tax breaks in big markets has lowered demand, putting pressure on prices and reducing profits in the car business.

Secondly, Tesla’s move into Physical AI is expensive. Their Q4 2025 earnings report showed they plan to spend $20 billion in 2026. Elon Musk is betting big on the Cybercab and Optimus robots, but the market isn’t happy about the shrinking car profits, which are now below 18%, and the end of the Model S and X lines. While some think this is just a temporary dip before the robotaxi and Optimus projects take off, it’s worth considering that there are risks and profit pressures that could last longer than expected.

The $400 Question

There’s a real risk that Tesla’s stock could fall below $400 soon. The $400 level has been a key support point in the past, but if it falls below that, it could drop to $380 or even $350 if things get worse. The $400 level is more than just a number; it’s an important valuation benchmark. While some worry about falling car sales, they often overlook the energy storage part of the business.

MarketPulse reports that Tesla’s energy business is growing by almost 80% each year and has much higher profit margins than the car division. If the stock goes under $400, it enters a value zone where the energy and software (FSD) businesses are essentially being given away for free. I think big investors are waiting around $395–$400 to buy in and provide support.

Can Tesla Reverse the Downtrend?

For Tesla to change the current trend and start growing again, it needs a few things to happen. Better-than-expected Q1 delivery numbers, together with good news about Full Self-Driving (FSD) approvals in key markets, would help boost confidence. Progress on the Optimus robot production schedule and successful energy storage deployments (especially Megapack) could also shift the focus to Tesla’s long-term AI and robotics goals.

Tesla Stock Price Prediction

Tesla stock’s RSI is at 42, showing control by the sellers. The downtrend will likely persist if the action stays below the Volume Weighted Moving Average level at $415. With that, primary support is likely to be the psychological $400 level. Breaking below that could clear the path to go lower and test $390.60. The first key resistance will be at $422, with the second one coming at $430.60.

Tesla stock on the daily time frame with key levels of resistance and support on February 18, 2026. Created on TradingView

Lower vehicle deliveries, shrinking profits due to price cuts and competition, and delays to robotaxi plans have all affected investor confidence. This also challenges the idea that AI growth will quickly make up for auto weakness.

It’s possible, but the $400 level has strong support due to the energy-growth fundamentals. A drop below this level would likely be temporary unless there is a big delay in the Cybercab production or a larger market crash.

In 2026, the narrative is shifting. With the Model S and X gone and big investments in Optimus and AI chips, Tesla is turning into a Physical AI and energy infrastructure company.