- Palantir Stock (NYSE: PLTR) extended its two-day losing streak to -16% on Wednesday after a research note warned of "cracks emerging".

Palantir Stock (NYSE: PLTR) extended its two-day losing streak to -16% on Wednesday after a research note warned of “cracks emerging”. RBC Capital Markets analyst Rishi Jaluria slashed his price target for PLTR to $19 from $25, lowering his rating to underperform.

The downgrade follows Tuesday’s third-quarter earnings commentary, showing revenue grew 26% YoY, a sharp slowdown from the 49% increase in Q2. However, a closer look revealed growth in government revenue dropped from 66% in Q2 to 34% in the most recent quarter.

Jularia’s note said, “We believe Palantir got direct benefits from COVID-related spending, and those benefits have already faded,” and warned of “cracks emerging in the story”.

PLTR Price Analysis

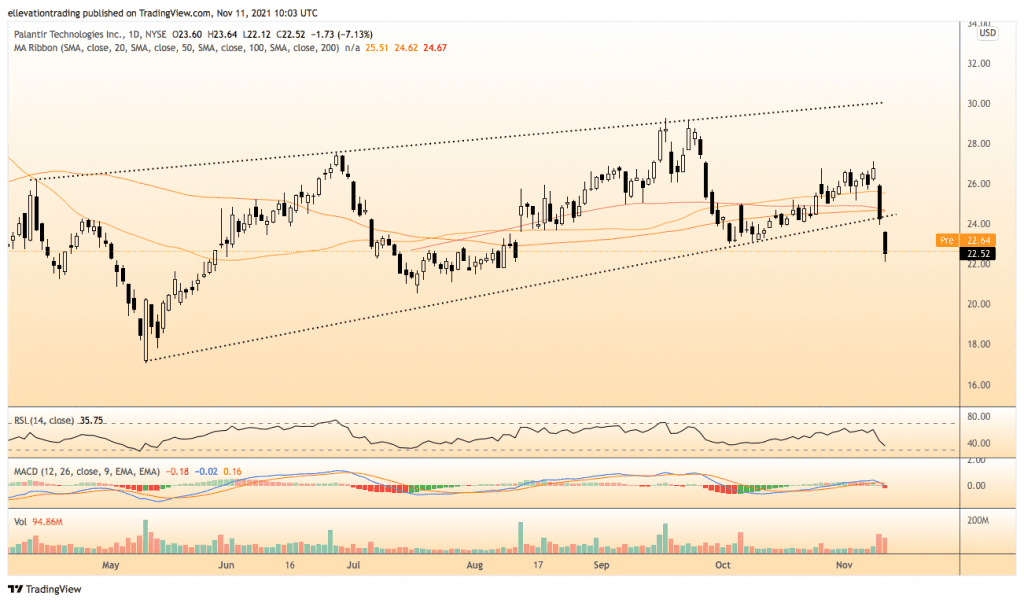

The daily chart shows Palantir stock closed below the bottom edge of an ascending trend channel and the 200-Day Moving average on Tuesday. As a result, the selling accelerated in Wednesday’s session, driving PLTR to a three-month low of $22.12 before settling at $22.52.

As long as PLTR remains below the trend, the path of least resistance is lower. The July low of $20.55 is the first notable support level. And 2its proximity to the psychological $20.00 level may encourage some tentative buying. In contrast, a steeper decline could extend towards the May low of $17.06.

The Relative Strength Index is getting close to oversold. However, the reading of 35 doesn’t indicate an immediate reversal. Therefore, I expect the price will continue lower, targeting $20.00. However, a close above the 200 DMA at $24.67 invalidates the bearish view.

Palantir Stock Price Chart (daily)

For more market insights, follow Elliott on Twitter.