- Lucid stock surged to its highest closing price in 10 months after the EV-maker confirmed Air Dream Sedan deliveries would begin.

Lucid stock surged to its highest closing price in 10 months after the EV-maker confirmed Air Dream Sedan deliveries would begin. Lucid Group (NASDAQ: LCID) reached an intraday high of $39.78 on Thursday after announcing that customers will soon be behind the wheel of the $169,000 premium vehicle. LCID finished the day at $35.38 (+31.31), an increase of 145% since September 1st.

The stock received another boost when Lucid CEO Peter Rawlinson revealed the Lucid Air outperforms Tesla in one department. The Air model is the longest-range electric vehicle, capable of travelling 520 miles on a single charge. Subsequently, some of Tesla’s shine has rubbed off Lucid group, which should provide a considerable tailwind for the stock in the coming weeks.

LCID Price Forecast

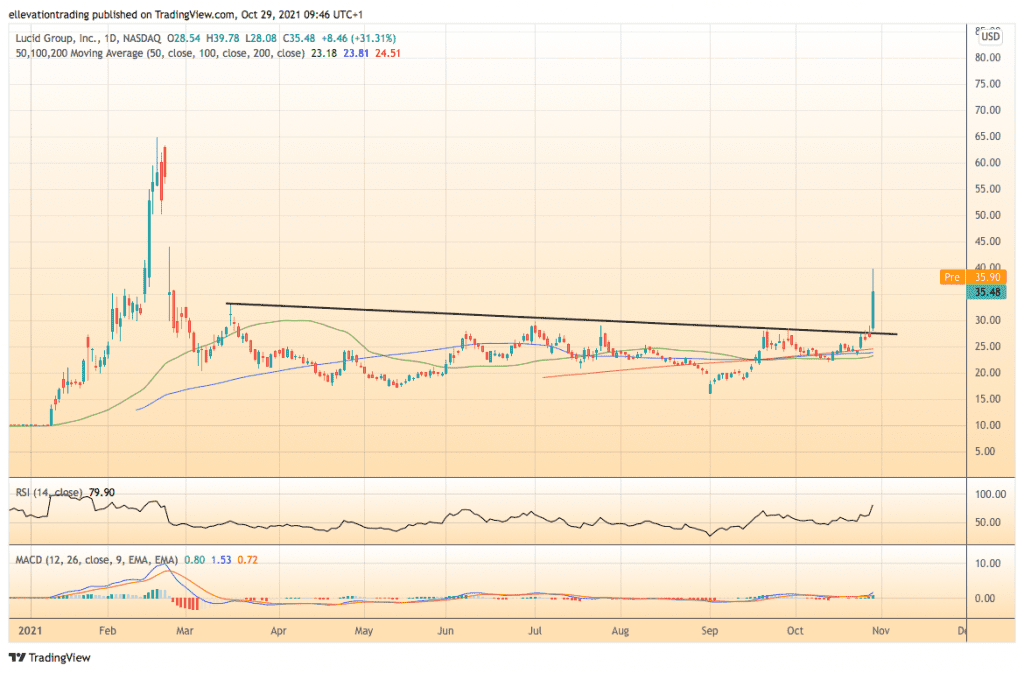

The daily chart shows LCID burst through trend line resistance at $27.50 on Thursday. Furthermore, the spike has pulled the price clear of the 50, 100 and 200-day moving averages at $23.18, $23.81 and $24.51, respectively. However, the Relative Strength Index at 79.90 indicates the rally is overbought. Nonetheless, the magnitude of the news should propel the price even higher.

Whilst it’s difficult to say precisely how high the stock can go, a logical target for the bulls is the $64.86 all-time high. Considering how well TSLA is performing, you can make an argument for an extension towards $64.86. As long as LCID remains above the trend resistance-turned-support, the outlook is bullish. Therefore, a close below $27.50 invalidates this thesis.

Lucid Stock Chart (Daily)

For more market insights, follow Elliott on Twitter.