- Steel prices have been rising recently, from ₹47, 500 in late 2025 to ₹53, 500 in February 2026

- Motilal Oswal and ICICI Securities have a "Buy" rating on Tata Steel with the price target suggesting 15%-20% growth headroom

- There's an underlying risk of oversupply in 2026, which could exert downward pressure in the coming months

Tata Steel has made an impressive start to 2026, touching an all-time high of around ₹211 and rising 15% so far this year. This is quite an achievement in a market that has been quite muted, and it is a far cry from the days when the steel sector was struggling. A closer look at Tata Steel reveals more fundamental factors that could sustain the current momentum for longer than anticipated, as well as risks that are often overlooked.

Understanding the Current Steel Price Rally

The imposition of safeguard duties on steel imports has protected the domestic industry from lower-priced imports, especially from China. At the same time, the expansion of capacities at Kalinganagar and other plants is poised to help Tata Steel tap into the growing demand from the infrastructure and manufacturing sectors.

Contrary to the widely held view that this rally is only cyclical and will subside with the next global downturn, Tata Steel’s strategy of concentrating on value-added products and green steel projects provides a more sustainable competitive edge. Tata Steel’s plans to further strengthen high-margin businesses and tap into government outlays for infrastructure development provide a tailwind that is absent in most other steel stocks.

Many think this rally is just cyclical and will likely fade with any global slowdown. But Tata Steel’s focus on value-added products and green steel initiatives gives it a more lasting competitive edge. The company’s push to expand high-margin segments and leverage government infrastructure spending creates a boost that many other steel companies simply lack.

Is Tata Steel Fairly Valued?

Tata Steel is currently trading at a Price, to, Earnings (P/E) ratio of about 14.5x based on the forward earnings estimates for FY26. At first glance, this seems like the company is trading at a discount compared to its five, year average. The price, to, earnings ratio looked quite reasonable especially after considering the company’s growing capacity and improving product mix. The stock combines the attractiveness of growth potential and valuation support quite well.

Still, calling it “cheap” might miss how global oversupply could hurt profits, especially if material prices jump fast. A well, rounded evaluation would point toward the valuation being reasonable for a company that is domestic market, oriented and doing well, but the company would have very little margin for error if the external environment deteriorates.

Generally, analysts have a positive outlook toward the Indian steel sector. Prices of Hot, rolled coil in India have significantly increased from around ₹47, 500 per tonne in late 2025 to almost ₹53, 500 per tonne in February 2026, thus providing a palpable increase to realisations. The industry outlook is supported by anticipated 8-10% demand growth and safeguard measures, but global factors are still a matter of concern.

Motilal Oswal and ICICI Securities continue to rate Tata Steel as a Buy with targets suggesting the stock can rise by 15-20%, they are convinced that better fundamentals and capacity additions will be the major drivers of the stock price.

Tata Steel Stock Technical Analysis

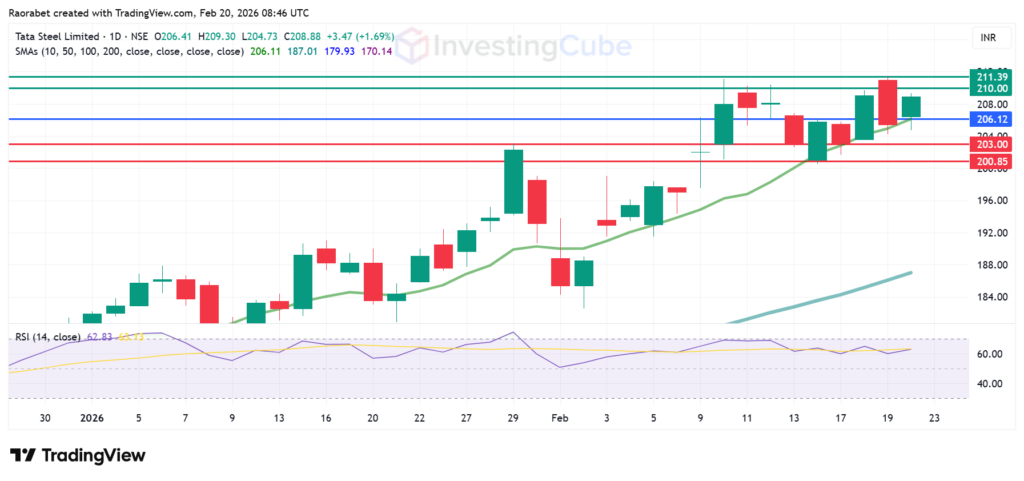

Right now, Tata Steel sits in a strong buy range. Well above both the 50-day and 200-day moving averages, price action shows steady footing. Not far off, the RSI reads near 62.83, which shows strong momentum, yet short of extreme levels.

The primary barrier is at ₹210 and clearing it might open room to retest ₹211.39 record highs. Below the pivot mark at ₹206.12 the momentum will shift to the downside, with its initial support likely to come at ₹203.00. The second support will likely be at ₹200.85.

Tata Steel share price on the daily time frame with its key levels of resistance and support on February 20, 2026. Created on TradingView

Even though most experts see gains ahead, blind spots around Europe’s re-rolling shift might slip through. Shifting phases means thinner profits, reliance on foreign base material sneaking in. Earnings could wobble, no matter how loud the India growth story plays.

While global demand is expected to grow a modest 1.3%, India remains a global outlier with a 9.1% growth forecast. This positions Tata Steel to benefit uniquely from domestic infrastructure and manufacturing booms.

The momentum is likely to remain in the near term if domestic demand holds and prices remain firm, though global overcapacity risks could test it more than consensus expects.