- Summary:

- What is the outlook of the Scottish Mortgage share price forecast? We explain what to expect as growth stocks stumble

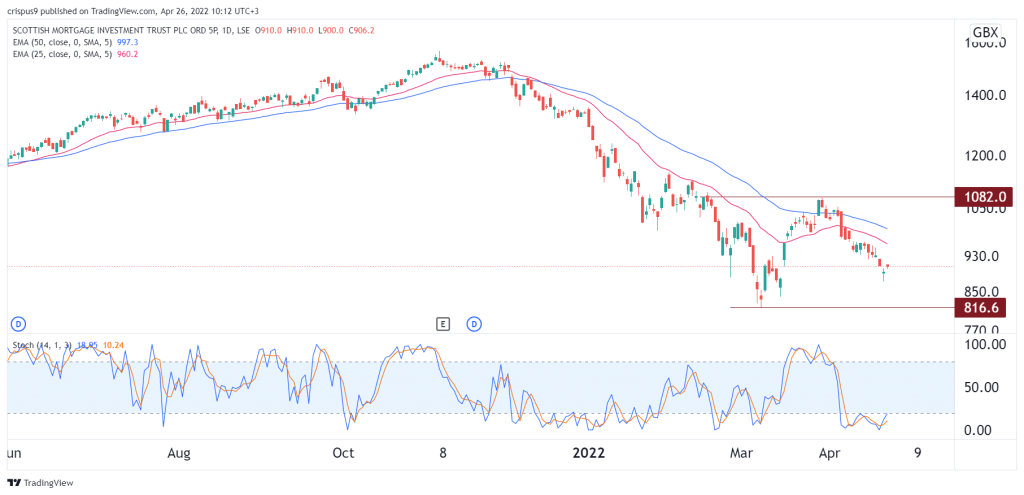

The Scottish Mortgage share price is languishing as technology stocks come under intense pressure. The SMT stock price is trading at 893p, which is close to its year-to-date (YTD) low of 816p. It has dropped by more than 43% from its highest level in 2021, bringing its total assets to over 16.5 billion pounds.

Is SMT a good buy?

Scottish Mortgage is the flagship fund for Baillie Gifford, one of the most popular fund managers in the UK. The company has over $400 billion in assets, making it a leading player in the asset management industry. For years, Scottish Mortgage has been one of the best performing funds in the UK.

Scottish Mortgage has gone through a period of transition. While it was started as a mortgage-based fund, it has transitioned to offer other asset classes. Indeed, most companies in the fund are not in the mortgage industry. The biggest constituent is Moderna, the vaccine company whose stock price has crashed from a high of $476 in 2021 to $150.

The next biggest Scottish Mortgage constituent is Tesla, the biggest automaker in the world. Tesla published encouraging results last week as it defied the ongoing margin pressures. The other large constituents ate ASML, Illumina, Tencent, Nvidia, Amazon, Kering, and Alibaba.

Most of these firms have been going through challenges. For example, the Alibaba stock price has crashed from an all-time high of $323 to the current $85. Likewise, Nvidia has struggled because of the perceived slowdown of the PC and data centre business.

Other smaller holdings in the Scottish Mortgage Investment Trust are Carvana, Clover Health, Meituan, Netflix, Nio, Shopify, Zoom Video, and Warby Parker, among others. Therefore, since these are all growth stocks, there is a likelihood that the Scottish Mortgage performance will lag in the near term as rates rise.

Scottish Mortgage Trust share price forecast

The daily chart shows that the SMT share price has been in a strong bearish trend in the past few months. As a result, the stock has crashed below the 25-day and 50-day moving averages. In addition, the Stochastic oscillator has moved below the oversold level. Therefore, the path of the least resistance for the trust is lower, with the next important support being at 816p. A move above 930p will invalidate the bearish view.