- Summary:

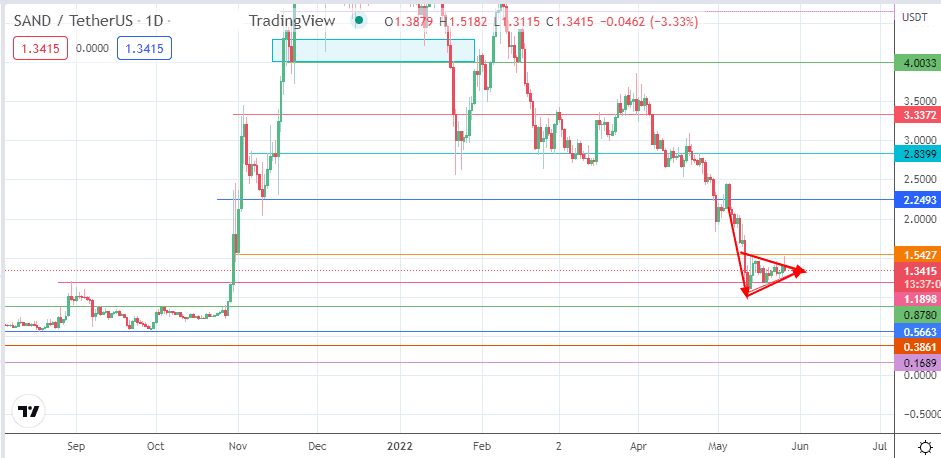

- The Sandbox price prediction is for the price activity to dip below $1 if the pennant resolves with a bearish continuation.

A brief 10% surge on Thursday almost lifted bullish Sandbox price predictions, but a quick reassertion of control by the bears quashed any bets of a further advance. The SAND/USDT pair is currently trading lower by 3.65% as the pair lost all of its initial gains on the day to a quick reversal.

The initial jump seen in the pair was a knee-jerk response to the announcement of the collaboration between the popular Metaverse platform and the Elvis On-Chain. This project aims to bring the work of late rock and roll legend Elvis Presley to the metaverse. This project will involve input from several Sandbox partners, such as MetaKey, Decentraland and Voxel Architects, and will also feature contributions from the Elvis Presley Enterprises and Run It Wild, a Web 3.0 studio.

Technically speaking, the intraday rejection at the 1.5427 resistance level has ensured that the bearish pennant’s evolution remains intact. The bearish Sandbox price prediction of a downside break and bearish continuation will only be fulfilled if the bulls fail to defend the support at 1.1898, as the Sandbox price prediction outlook below indicates.

Sandbox Price Prediction

The intraday decline came off a rejection of the price activity from the 1.5427 resistance point (1 November 2021 low and 14 May 2022 high). This rejection keeps the price activity within the pennant and preserves its integrity. The downside move has to challenge and overcome the pattern’s lower border to complete the expected bearish continuation move.

This move has to degrade the 1.1898 price mark to continue toward the 3 October/26 October 2021 highs at 0.8780. With the measured move’s completion at 0.3861 (20 July 2021 low), the breakdown of 0.8780 must also be followed by a degrading of the support at 0.5663 (3/25 August 2021 lows) to attain completion.

On the flip side, clearance of the resistance at 1.5427 invalidates the pattern. It opens the door for a recovery move that targets 2.2493 initially (11 November 2021 low) before 2.8399 (12 November 2021 and 24 April 2022 highs) comes into the picture. There is potential for the 2.5000 psychological resistance (29 April 2022 high) to form a pitstop between 2.2493 and 2.8399.

SAND/USDT: Daily Chart