- Summary:

- The S&P 500 index pushes closer to new record highs as Joe Biden takes office as the new US President, promising additional stimulus.

The S&P 500 is trading higher today as the US markets respond positively to the end of the long-drawn US presidential election battle that will

culminate in the swearing-in of Joe Biden as the new President later today. Biden has promised to wage war on the coronavirus pandemic in the US

using new methods that the previous administration seemed gun-shy of, and is also promising extended stimulus.

The US markets are also applauding calls by the former Fed Chair and incoming Treasury Secretary, Janet Yellen, to the Senate Committee on Finance to take big steps at radically expanding stimulus. She has also promised to work tireless to get a second stimulus package approved.

The stance by Yellen, which was a solid confirmation of the previous promises by the incoming president, is a boost to the markets and this has sent the S&P 500 index higher by 0.63%.

Technical Levels to Watch

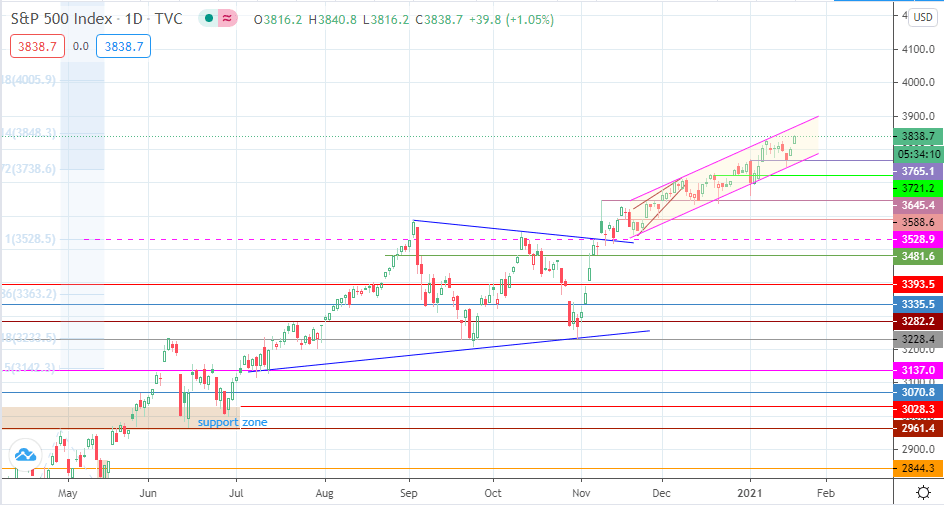

The S&P 500 is an inch short of touching the previous all-time high at 3826.7. A break of this level puts the S&P 500 index into new record territory, and the 141.4% Fibonacci extension at 3848.3 could be the next target in line. Above this area, 4005.9 could be a potential resistance target which intersects the channel’s return line, being found at the 161.8% Fibonacci extension level.

On the flip side, failure to attain the previous all-time high stalls further progress to the north. A pullback from here targets 3765.1 initially,

followed by 3721.2 and 3645.4 as additional downside targets.

S&P 500 Daily Chart