- Summary:

- The RVNL share price rose by more than 10 percent for the second successive session on Monday, bringing its YTD gains to 210 percent.

RVNL share price rallied on Monday, rising by 15.2 percent in the intraday session to trade at Rs 565.9 at the time of writing. The stock had touched a new all-time high of 578.95, underlining the strong buying momentum. Monday’s rally brings RVNL’s gains in the last two trading sessions to 34.4 percent, with its YTD rise at 210 percent.

State-owned RVNL’s rise is attributed to news that it had signed an MoU with the Delhi Metro Rail Corporation Limited (DMRC) for participation in upcoming projects in India and abroad. According to an exchange foiling, that could see RVNL rake in revenue from various new projects such as Metro, Railways, High Speed Rail, Highways, MegaBridges, Tunnels, Institutional Buildings/ Workshops or Depots, S&T works, and Railway Electrification.

The news comes on the back of the July 2 announcement by the corporation that it had won a Rs 132.59 crore contract from Central Railways for the modification of the modification of the Wardha-Ballarshah section to enhance its loading capacity to 3,000 metric tonnes.

Meanwhile, India’s Ministry of Railways plans to add 10,000 non-AC coaches in the mid-term to cater to the rising demand for non-luxury railway capacity in the nation. That figure will be spread out into 4,4485 coaches in the current financial year and 5,444 coaches in the 2025-2026 FY. The Indian government allocated railways infrastructure development projects Rs 2.55 trillion in the current financial year, up from Rs 2.4 trillion in the 2023-25 FY. That will likely propel many railway stocks high in the near and mid-term.

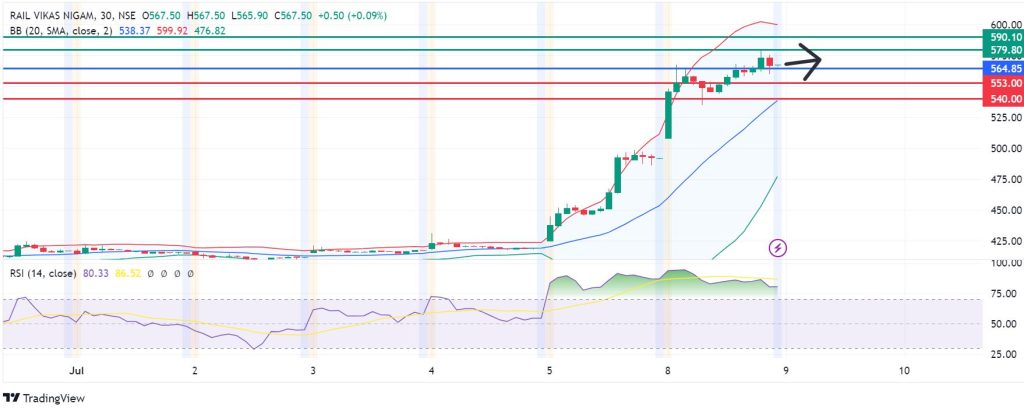

Technical analysis

The momentum on RVNL share price signals control by the buyers, and the pivot mark will likely be at 564.85. The upside will likely meet the first resistance at 579.80, but extended control by the buyers will break the resistance and potentially move the stock to 590.10. Conversely, a move below 564.85 will favour the sellers to take control. The downward momentum will likely find the first support at 553.00, beyond which the upward narrative will be invalid. Furthermore, it could strengthen the downward momentum to test 540.00.