- Summary:

- Russell 2000 continued its bullish trend as the VIX index slumped to the lowest level in months. What next for the small-cap index?

Russell 2000 continued its bullish trend as the VIX index slumped to the lowest level in months. The index soared to a high of $2,016, which was the highest level since April 21st. It has jumped by more than 22.50% from the lowest level this year. Similarly, the Dow Jones, Nasdaq 100, and S&P 500 have all jumped sharply in the past few weeks.

VIX index slips

The VIX index is a leading metric that measures the amount of volatility in the market. Precisely, the index looks at the options data in the S&P 500 index to determine the level of volatility in the market. Therefore, it is one of the most important indices in the market. However, in most cases, the VIX has an inverse relationship with American indices like the Nasdaq 100 and Russell 2000.

The Russell 2000 index, which is made up of small-cap companies, has been in a spectacular rebound recently. First, investors believe we have seen the worst of the ongoing sell-off. Besides, the index had declined by more than 20% from its highest point this year.

Second, data published last week showed that inflation has decreased as the cost of fuel declines. Precisely, it moved from the year-to-date high of 9.1% to 8.7% in July. This decline was bigger than what analysts were expecting. As a result, analysts believe the Federal Reserve will start slowing down on its rate hikes in the coming months.

Third, the earnings season has not been as bad as analysts were expecting. Indeed, according to FactSet, most companies that published their quarterly results had a positive revenue and earnings surprise.

Russell 2000 forecast

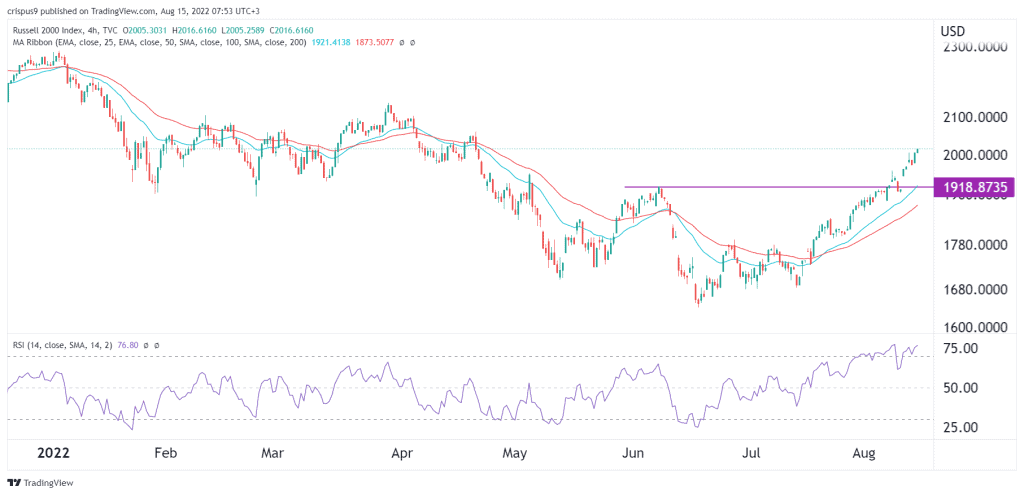

The four-hour chart shows that the Russell 2000 index has been in a strong bullish trend in the past few weeks. During this period, the index managed to move above the important resistance level at $1,918, the highest level on June 8th. In addition, the index remains above the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) moved to the overbought level.

Therefore, the index will likely continue rising as buyers target the next key resistance point at $2,100. A move below the support at $1,918 will invalidate the bullish view.