- Summary:

- The Royal Mail share price is set for a steeper slide after it failed to clear the resistance level at 259.3.

The Royal Mail share price has had an underwhelming start to the week as the impact of the strike by thousands of British postal workers hits home. The UK’s spiraling inflation has forced several labour unions to go on strike after negotiations with employers to bridge the gap between the 10% inflation rate and the current wages that failed to yield any fruit.

In the last week of August, more than 115,000 postal workers of the Royal Mail Group began a strike action after a dispute over pay. The Bank of England projects UK inflation to hit 13.3% at the end of the year, but Goldman Sachs says UK inflation could hit 24% by the 1st quarter of 2023.

The Royal Mail share price has not performed well in 2022. It was already facing pushback from declining parcel volumes and a drop in shipments of COVID-19 test kits, which had hit a 2021 peak around the time the Omicron variant hit the market.

The Communication Workers Union to which Royal Mail’s workers belong had rejected the 2% initial increase given by the RMG, citing a sharp discrepancy between this increase and the national inflation rate. The Royal Mail share price remains under pressure this Monday, down 1.62%.

Royal Mail Share Price Forecast

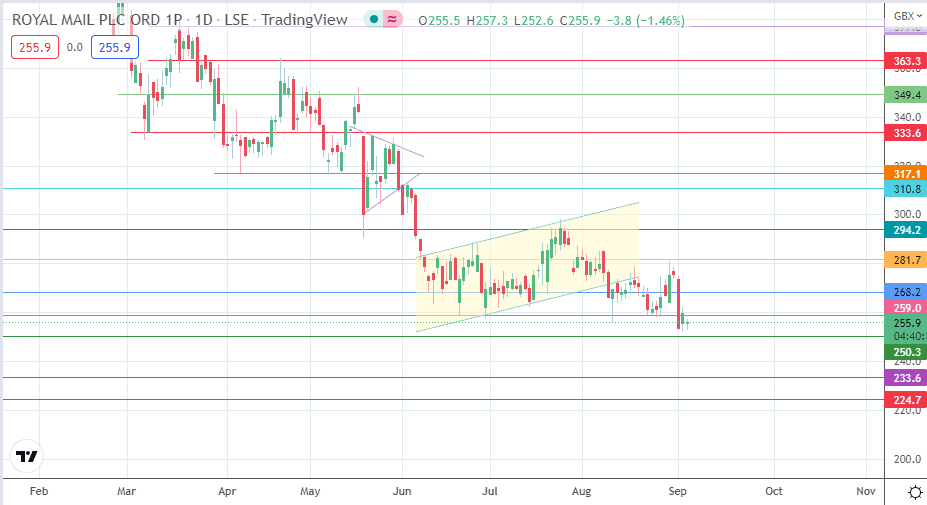

The failure of the daily candle to breach the 259.0 resistance leaves the Royal Mail share price in the range formed by the 250.3 support (floor) and the 259.0 resistance (ceiling). A breakdown of 250.3 (10 November 2020 low) leads to a further decline, targeting 233.6 (30 September 2020 and 16 October 2020 lows). This is the completion point of the bearish flag pattern. If the bulls fail to defend this price support, 224.7 (30 October 2020 low) becomes an additional target to the south.

On the other hand, a break of the 259.0 price ceiling clears the path toward 268.2 (13 June and 20 July 2022 lows). A push higher sends the stock to 281.7 (23 June and 30 August 2022 highs) before 294.2 (21 July high) yields itself as an additional northbound target if the recovery move continues.

RMG: Daily Chart