- Summary:

- Royal Mail share price has been on a steep decline since January 13, 2022, losing 26 percent of its value during that period.

The Royal Mail share price has been on a steep decline since January 13, 2022, losing 26 percent of its value during that period. Today, the share prices have already fallen by more than 1.5 percent. Fortunately, this price drop is likely to end soon as the company’s strong fundamentals come into play.

Royal Mail Balance Sheet

One of the best ways to tell the health of a company is by looking at its balance sheet. This can help you gauge the risk of investing in the company. It can also help you determine the financial status of a company in relation to its debt and cash in hand ratio.

Fortunately, the Royal Mail balance sheet shows that the company had UK£897.0m of debt in September 2021. This was a significant improvement from its debt of UK£957.0m. While this debt looks big, the company also boasts of having UK£1.63b in cash, a difference of UK£730.0m. This is a healthy debt to cash ratio, which means that it is very hard for the company to go into financial distress.

The balance sheet also shows that it had liabilities totalling UK£2.48b that were due within a year, and another UK£2.69b in long-term liabilities. When compared to its assets, the company has UK£1.99b worth of liabilities more than its assets, including cash in hand and receivables. In most cases, such a balance sheet can highlight a failing company. However, Royal Mail has a market capitalization of over UK£4.21b, hence, it can sort all its liabilities.

Royal Mail LON: RMG Share Price Prediction

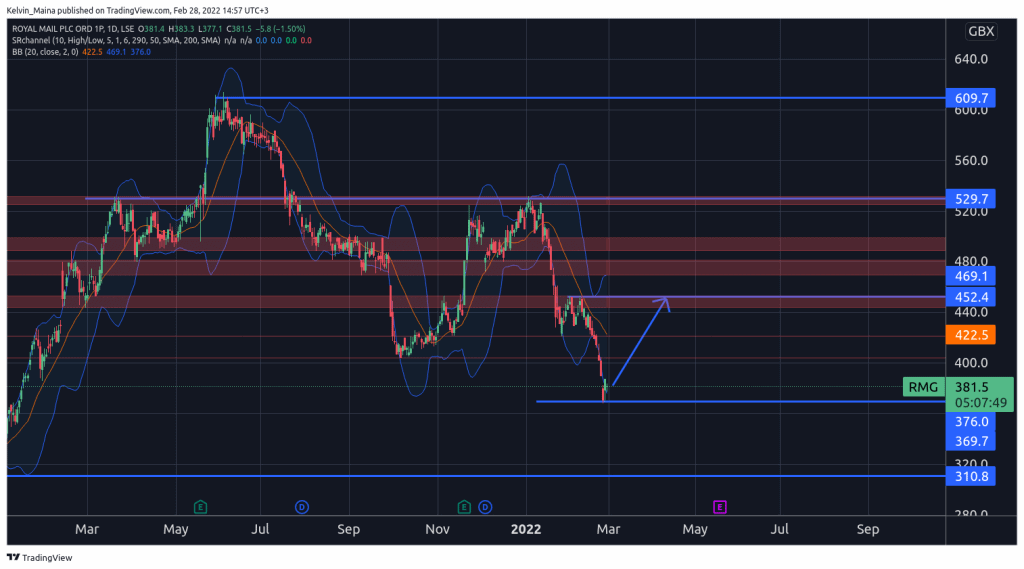

Royal Mail has struggled for the past few weeks, setting a new low of 369 GBx, before a small recovery that has seen its shares trading at 381 GBx. Luckily, the price action analysis shows a different picture of the Royal Mail share price.

For starters, the prices have not reached such a low since January 15, 2015. After hitting the 369 GBx support level, prices failed to break downward for two consecutive days last week before recovering and starting a bullish move. The prices are also showing aggressive signs of a bullish move based on the fact that they are bouncing from a support level. For this reason, I expect the current bullish move to hold, and the LON: RMG share price to move higher and test the long-term resistance level of 452 GBx. However, if the price reverses and breaks below the 369 GBx support level, then my trade analysis will be invalidated. This will mean the bearish move will continue.

Royal Mail Daily Chart