- Summary:

- The Royal Mail share price has been in a tight range in the past few days as investors reflect on the company's acquisition of Roseneau

The Royal Mail share price has been in a tight range in the past few days as investors reflect on the company’s large Canadian acquisition and the overall growth of the company. The RMG share price is trading at 420p, which is slightly above this month’s low of 400p.

Royal Mail stock stalls

Royal Mail is big British company that is well-known for its parcel and letter business. The company has benefited substantially from the Covid-19 pandemic, which led to substantial growth of its parcel business. As a result, the stock surged, pushing it to the FTSE 100 index.

However, there are increasing concerns about the company. For one, as the UK economy recovers, the demand for online shopping will start to decline. Indeed, the management has said that its demand is slowing. But it expects that demand will remain above where it was before the pandemic.

The company has also moved to expand its business. This month the firm said that it will acquire Rosenau, a Canadian logistics company. The goal is to diversify its revenue by capturing an industry that is showing substantial growth.

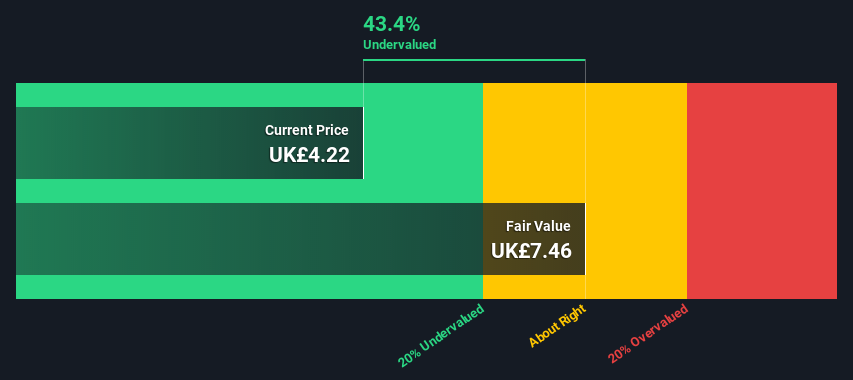

At the same time, the Royal Mail share price decline has made the company to be relatively undervalued. According to Simply Wall St, the company’s share price is about 43.4% undervalued. This calculation is based on a discounted cash flow, as shown below. So, what next for the stock?

Royal Mail share price forecast

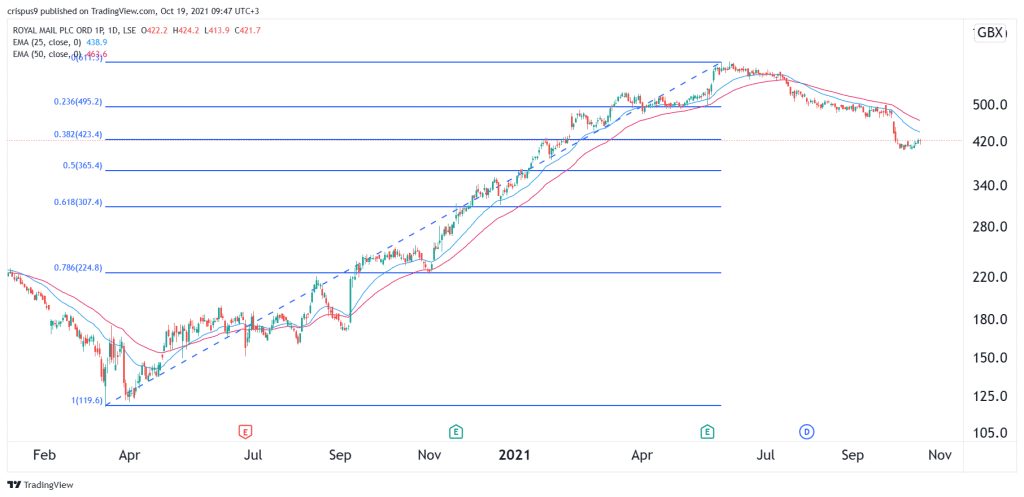

The daily chart shows that the RMG share price has been in a bearish trend in the past few days. The stock has declined by more than 32% from the highest level this year. Notably, it is along the 38.2% Fibonacci retracement level. It has also moved below the 25-day and 50-day moving averages. Also, it seems like it is forming a bearish flag pattern.

Therefore, while the stock is undervalued, there is a likelihood that it will keep falling as bears target the next key support at 365p, which is along the 50% Fibonacci retracement level. On the flip side, a move above 450p will invalidate the bearish view.