- The Royal Mail share price is up this Friday, but remains in a precarious position as a nationwide strike looms.

The Royal Mail share price is up 2.22% as investors shrug off the potential for a strike action that will cripple the operations of the Royal Mail Group and the UK postal system.

Most Royal Mail staff who voted on Wednesday favoured a nationwide industrial action to protest a proposed redeployment program, job cuts and pay. Royal Mail Group had planned to cut 542 delivery manager jobs and kick off a redeployment process which workers say comes with deplorable terms and conditions.

The Royal Mail share price fell by more than 5% on Wednesday following the vote but has been able to claw back most of those losses. However, the stock remains poised to end the week lower. If the Royal Mail share price closes at present levels or lower, it will be the fourth week in five that the stock will close lower, continuing a poor run that has seen the stock tumble from a 4 January high of 531.4, amounting to a loss of 48% from the start of the year.

Royal Mail Share Price Forecast

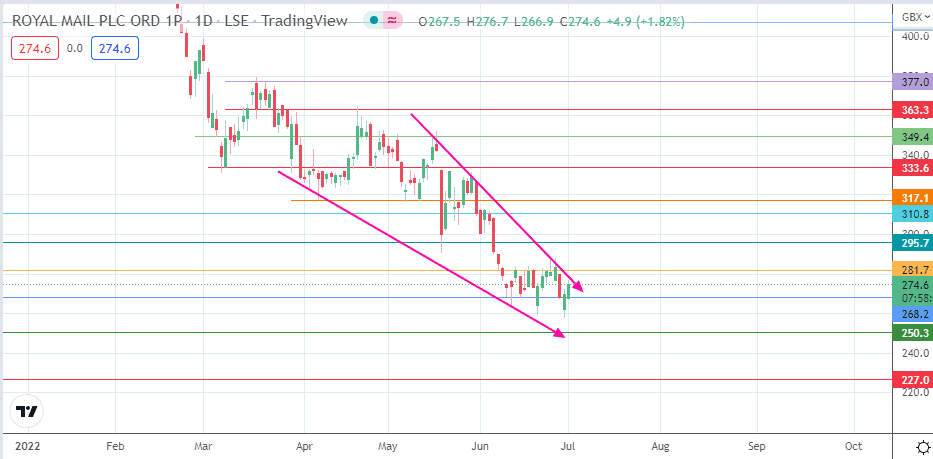

The intraday uptick could be a bull trap that uses the rally to set up a short position. This outlook will hope on a rejection of the price action at the 281.7 resistance (15 June – 24 June highs). A pullback from this level targets 268.2 initially (16 June low) before a further decline brings the action to the 260.0 psychological support (4 November 2020 high and 22 June 2022 low).

Additional targets to the south are found at the 250.3 price (10 November 2020 low) and at 240.0 (26 October 2020 low). 227.0 rounds off potential short targets to the south. On the other hand, a break of 281.7 invalidates the outlook above. In this scenario, 295.7 emerges as the next upside target, being the site of the 23 November 2020 low acting in role reversal.

Above this level, the bulls would seek further northbound targets at 310.8 (8 June 2022 high) and at 317.1 (6 April and 9 May lows in role reversal). A bullish reversal of price action from the downtrend takes on more momentum if the bulls take the advance further, targeting a break of 333.6 and 349.4 (5/17 May highs).

RMG: Daily Chart