- What is the outlook of the Royal Mail share price for September 2021? We explain the key levels to watch as demand concerns remain

The Royal Mail share price had a difficult month in August. The RMG stock declined from a monthly high of 517p to a low of 481p as investors remained concerned about the company’s recovery. It ended the month at 495p, which was about 3% above the lowest level during the month.

Why Royal Mail is struggling

Royal Mail has generally done well this year as its stock has risen by more than 30%. In the same period, the FTSE 100 index has risen by less than 5%.

This performance has been because of the recent demand for its services as more people have turned to e-commerce platforms for their shopping. As a result, the company has reported strong results this year and even boosted its dividends.

Therefore, there is the lingering question about whether this demand will remain intact in the second half of the year. Indeed, many companies with exposure to e-commerce have lagged. A good example of this is Ocado, whose stock has declined by more than 30% from the highest level this year.

September will be an important month for the Royal Mail share price. The company will publish the latest trading statement on September 23. This will be an important release because it will send a picture of the company’s growth.

Royal Mail share price forecast

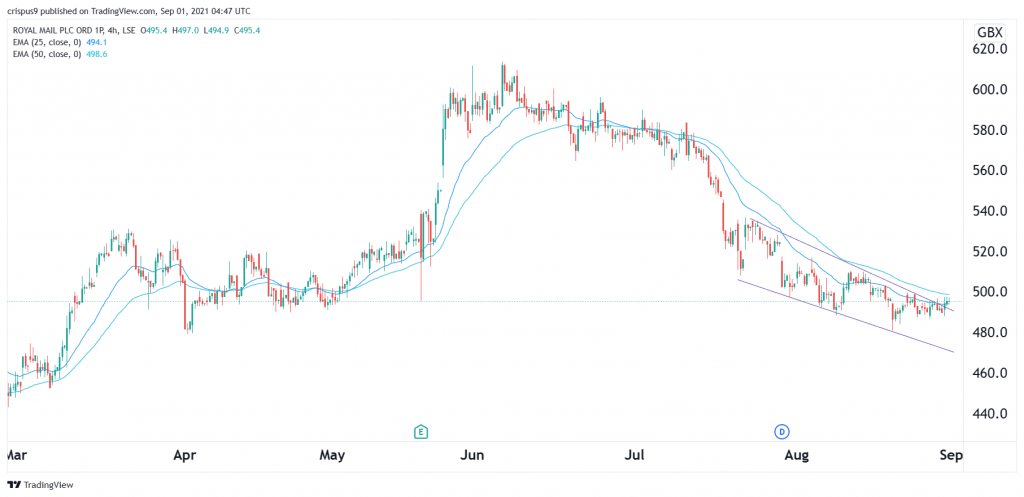

The four-hour chart shows that the RMG share price has been under intense pressure lately. The stock has declined by almost 20% from its highest level in July. At the same time, it is trading at the same level as the 25-day and 50-day moving averages. It has also formed a small descending channel.

Therefore, the stock will likely break out lower for the most part of September as its demand wanes. I even suspect that some of the existing holders will start to exit their trades. As such, there is a possibility that it will decline to the next support level at 450p. This view will be invalidated if the price moves above the key resistance at 500p.