- Summary:

- The Royal Mail share price moved sideways in October as investors reflected on the company's growth and its acquisition of Rosenau Transport,

The Royal Mail share price moved sideways in October as investors reflected on the company’s growth and its acquisition of Rosenau Transport, a leading logistics provider in Canada. The RMG share price has dropped by more than 7.50% in the past 30 days. It has also crashed by more than 30% from its highest level this year.

Growth concerns remain

The Royal Mail share price has struggled in the past few months as investors have focused on the company’s growth as the pandemic eases and the UK economy reopens.

The biggest concern is that demand for parcels will decline in the coming months as more UK residents move to buy directly from retailers. Besides, the government provided some tax breaks to retailers last week.

Another major concern is that the company will see higher costs of doing business. Besides, most companies have raised their employees wages in the past few months. At the same time, the company is expected to see more energy costs considering that fuel prices have risen sharply recently.

At the same time, investors are concerned about the company’s decision to buy Rosenau, a Canadian company. There is uncertainty about whether this acquisition will lead to more growth for the company.

The biggest catalyst for the Royal Mail stock price will be the upcoming interim results for the company. They will come out on November 18. In them, analysts will look at the overall financial performance and the forward guidance.

Royal Mail share price forecast

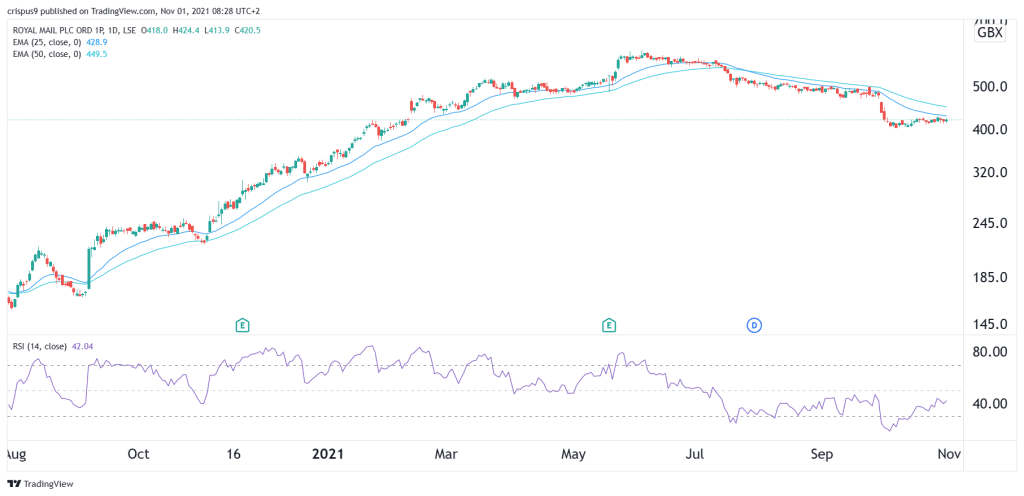

Thr daily chart shows that the Royal Mail share price has struggled substantially in the past few months. The stock has managed to move below the 25-day and 50-day moving averages.

A closer look shows that the stock has formed a horizontal consolidation pattern slightly above the 400p level. This consolidation seems like a bearish flag pattern.

Therefore, the stock will likely see a bearish breakout in November. If this happens, the next key support level to watch will be 350p. This view will be invalidated if the price moves above 500p.