- Summary:

- The Royal Mail share price action shows that bulls are struggling as COVID-19-induced worker absences cause postal delays.

The Royal Mail share price is struggling to pare some of yesterday’s losses, as it is only up marginally by 0.72%. Having lost some of the day’s gains from a pullback, the bulls are struggling to preserve the sanctity of the 509.6 price mark.

Monday’s steep 3.16% drop stems from investors’ concerns about worker absences at Royal Mail’s offices, which are now causing massive delays in several areas. The company says as many as 90 postcodes across the UK may expect delays in their post, with at least 21 postcodes in London being some of the hardest hit. COVID-19-induced worker absences are to blame, with the more easily transmissible Omicron variant said to be responsible. An increase in the holiday season demand has also created a spillover effect.

With the UK government considering shorter isolation periods and tweaking testing systems, the lack of clarity of the policy and its impact on businesses remains a sticky point for the Royal Mail share price.

Royal Mail Share Price Outlook

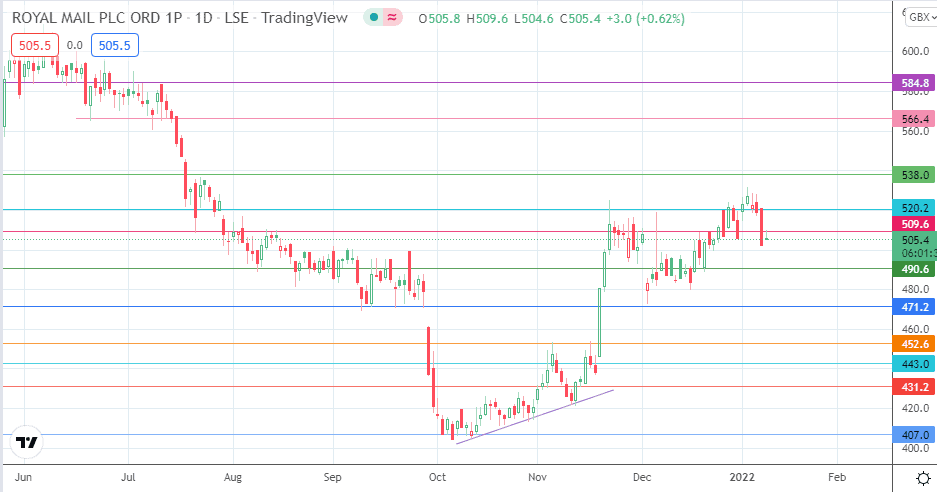

The active daily candle has met resistance at the 509.6 price level, the site of the previous support, broken by Monday’s candle. If the candle closes below this resistance, its sanctity is preserved and the breakdown move, which commenced on Monday, will be confirmed. This scenario opens the door for 490.6 to become the immediate downside target, followed by 471.2 and 452.6 if the corrective decline continues.

On the flip side, bulls need to force the active candle above the 509.6 price mark to negate the breakdown move. A follow-up bounce is required to take the price towards 520.2. This new upside target must give way, along with a push above the 5 January high at 531.4 for the recovery move to advance towards 538.0. 566.4 and 584.8 are distant targets to the north which become more visible if 538.0 gives way.

Royal Mail: Daily Chart