- What is the outlook of the Royal Mail share price now that it has fallen sharply in the past few months? We explain what to expect next.

The Royal Mail share price has seen no reprieve in the past few days as concerns about rising costs soar. The RMG stock price is trading at 340p, which is the lowest since January 2021. The shares have fallen by over 45% from the 2021 high. This means that investors have lost almost 2 billion pounds as the company’s market cap has dropped to 3.25 billion pounds.

Like many other companies in the industry, Royal Mail is struggling as the cost of doing business has escalated. Indeed, other companies like UPS and FedEx have seen their share prices collapse by 10% and 17%, respectively, in the past 30 days.

The main concern is that the price of fuel and labor has risen dramatically in the past few months. For example, in the UK, the price of diesel has risen to 1.75 pounds per litre and there is a likelihood that the trend will continue. As a result, the company has been forced to increase its fuel surcharge in the past few months. Also, the company decided to hike the cost of first-class letter business by 12%, which will likely affect its demand.

Analysts have turned sour on the Royal Mail share price. For example, in a recent note, analysts at Credit Suisse downgraded the stock and hinted that more sell-off is yet to come.

Royal Mail Share Price Forecast

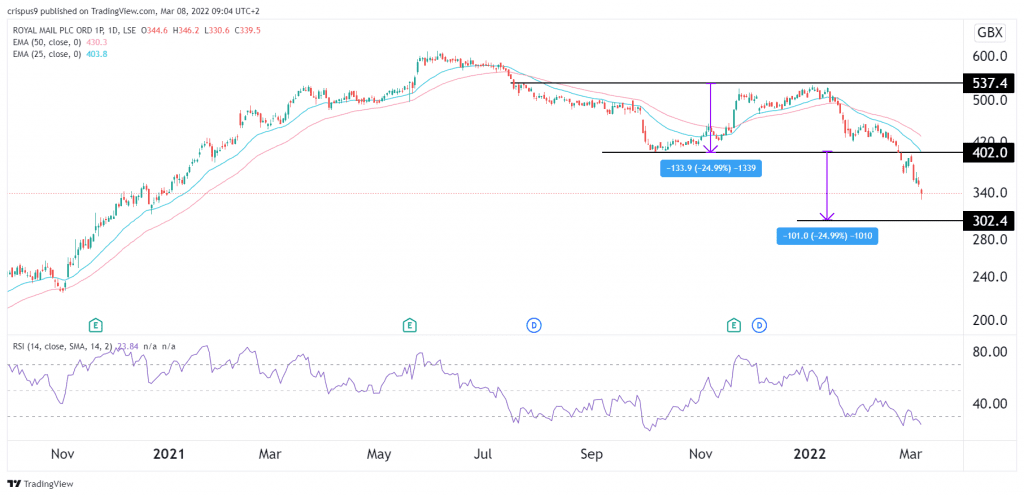

On the daily chart, we see that the RMG share price has been in a strong bearish trend in the past few months. The sell-off continued after the stock moved below the key support level at 402p, which was the lowest level on October 5th. This price was also the chin of the double-top pattern that formed. It has moved below the 25-day and 50-day moving averages.

Therefore, the stock will likely continue falling as bears target the next key support level at 300p. A move below the key resistance level at 450p will invalidate this view.