- Royal Dutch Shell share price has been in focus recently as investors reflect on the new activist pressure and the company’s exit from the Netherlands.

The Royal Dutch Shell share price has been in focus recently as investors reflect on the new activist pressure and the company’s exit from the Netherlands. The RDSA share price is trading at 1,609p, which is slightly below this year’s high of 1,793p. On the other hand, the RDSB share price has crashed to 1,610p, which is 12% lower than this year’s high of 1,811p.

RDSA vs RDSB

Many investors have been confused about the difference between the RDSA and the RDSB recently. This confusion stems from the fact that Royal Dutch Shell announced that it will change its headquarters from the Netherlands to London.

The company cited the relatively higher taxes from the Netherlands. Most importantly, it cited the 15% withholding tax charged by the Dutch government. This was the same reason why Unilever decided to shift its operations from the country.

There are several key differences between RDSA and RDSB. For starters, RDSA is the stock ticker for the company in the Netherlands. This means that RDSA is under the Netherlands tax system. It controls about 57.5% of the total company and has no voting power.

RDSB, on the other hand, is made up of the company’s transport and trading business. It falls under the UK tax system, meaning that its dividends and buybacks are not subjected to withholding taxes.

RDSB share price forecast

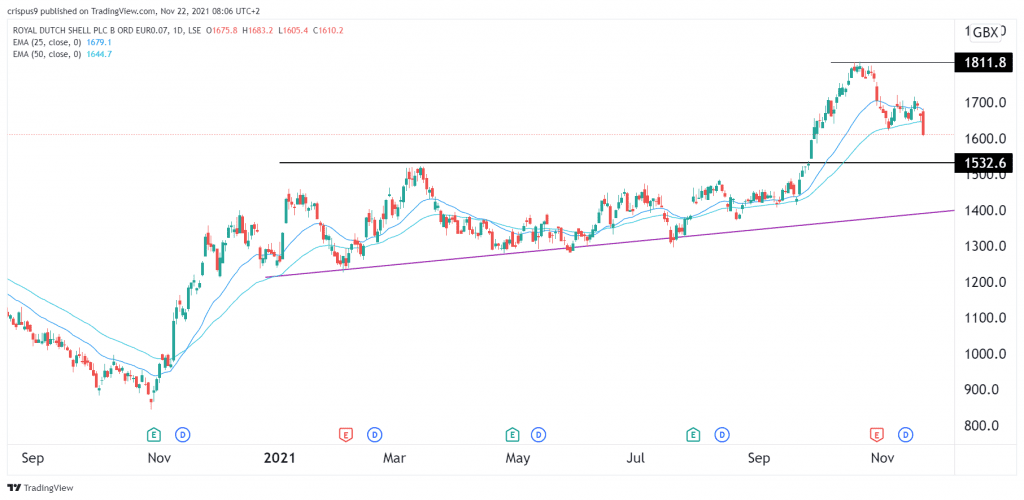

The daily chart shows that the Shell share price was in a major bullish trend recently. The stock jumped to an all-time high of 1,811p. In the past few days, the stock has dropped by more than 11% and is slightly above the key support level at 1,532p. This was the highest level on March 12. This weakness is in line with my previous Shell forecast.

Therefore, the stock seems to be forming a break and retest pattern. This means that it will likely resume the bullish trend in the near term. As I wrote in my previous article, I expect that crude oil price will also resume the bullish trend. This view will be invalidated if it drops below 1,530p. A DCF valuation also shows that the RDSB share price is undervalued by about 38.6%.