- Summary:

- The Royal Dutch Shell share price is facing additional downside pressure as crude oil prices fall on the day.

A drop in crude oil inventories from 3.3m barrels to 1.0m barrels for the week ended 5 November did not cause an increase in the Royal Dutch Shell share price. This is because of the cooling of Brent crude price on the day, which is down 1.37% as of writing.

RDSB and Baker Hughes are to work on a new collaboration to enhance energy transition to enable the companies to achieve their zero-carbon emission goals.

However, the markets continue to react negatively to comments attributed to the CEO of Shell, Ben van Beurden. The CEO had said in a BBC interview a week ago that any projects needed to enhance its conversion could only be paid for using its oil and gas business, signifying an intention to double down on its fossil fuel-driven business.

RDSB Share Price

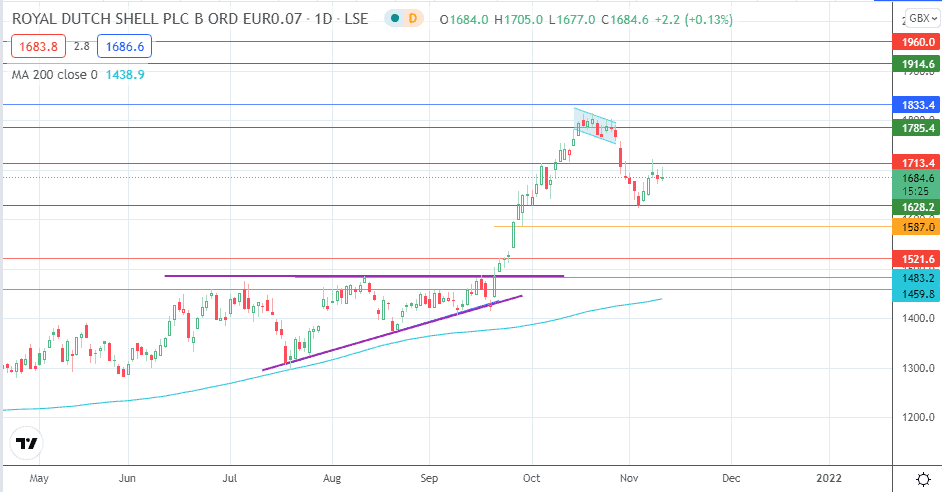

Following the measured move from the ascending triangle, the RDSB share price corrected from the 20 October highs towards the 1628.2 support. Another attempt at the upside has petered out at 1713.4.

The day’s earlier gains have been erased, with the Royal Dutch Shell share price dipping slightly lower. The bears need more momentum to drive the price towards the 1628/2 support (1 October and 3 November lows). Below this level, additional support comes in at 1587.0 (29 September low) and 1521.6.

On the flip side, the bulls need to overcome 1713.4 to bring 1785.4 into the mix as one of the upside targets. Other targets to the north may be seen at 1914.6 and 1960.0.

RDSB: Daily Chart

Follow Eno on Twitter.