- Summary:

- Royal Dutch Shell has rocked markets recently with a decision to move its headquarters and tax residency to the UK.

Royal Dutch Shell has rocked markets recently with a decision to move its headquarters and tax residency to the UK, while abandoning “royal” from its name after 130 years.

The company is also planning to cancel the dual-share structure, which has A and B share categories in circulation. That system dates back to 2005 when Shell united tow divisions with a UK incorporation and Dutch tax residency.

“It was not envisaged at the time of unification that the current A/B share structure would be permanent,” Shell said on Monday.

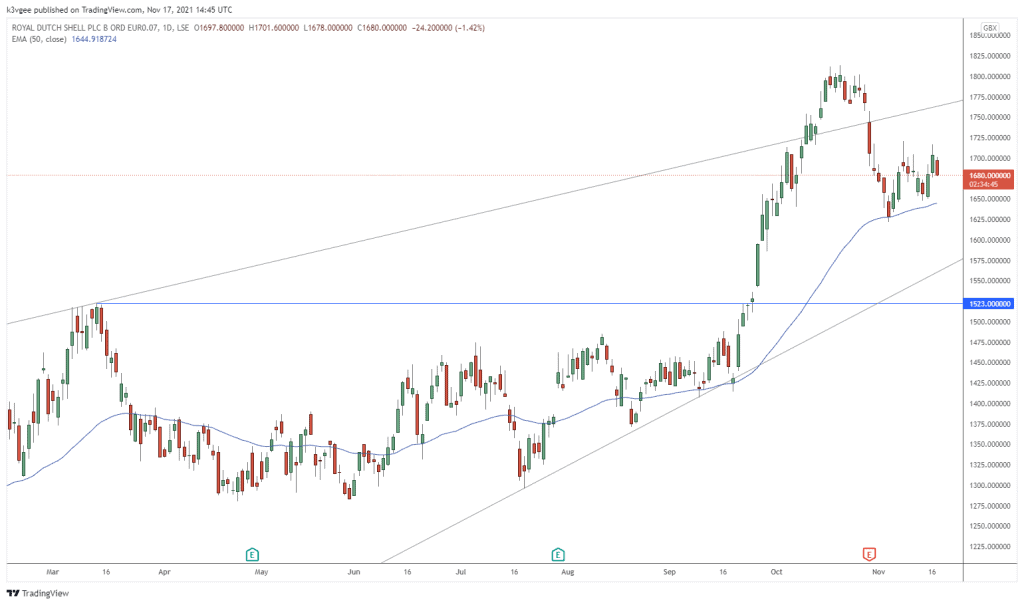

The decision by Shell could see some near-term volatility in the share price is investors seek to take profits ahead of the move, which has to be approved by shareholders. The share price has been cooling off after recent earnings but still has the support of $80 WTI crude prices.

Third quarter earnings missed analysts’ forecasts and revenue also fell short of expectations but the $61.6 billion figure was an improvement of 37% from the third-quarter 2020 sales of $44.7 billion. .

RDSB Price Chart