- Summary:

- The Rolls-Royce share price suffered its worst one-day performance since March 2020 as a new Covid variant spooked global equity markets.

The Rolls-Royce share price suffered its worst one-day performance since March 2020 as a new Covid variant spooked global equity markets.

Rolls-Royce Holdings (LON: RR) dropped to a two-month low of 121.56p (-11.62%) on Friday as the Omnicron Covid mutation sparked a deluge of selling. The engine-maker was one of the FTSE-100s biggest losers as investors bailed out of aviation and tourism-related stocks.

The worst fears from Friday are yet to play out on Monday. Global Indices are higher after experts dismissed claims the Omnicron variant poses a material risk. Furthermore, we haven’t seen significant changes to travel policy outside of a few African nations. And whilst the landscape is fluid, the overall view is that Friday’s downside move was exaggerated by the post-holiday trading conditions.

Risk-Appetite Returns

As well as indices trading green, importantly, Crude oil has spiked 5%, which is encouraging for the Rolls-Royce share price. Furthermore, despite Friday’s brutal price-action, RR held above several significant support levels.

RR Price Analysis

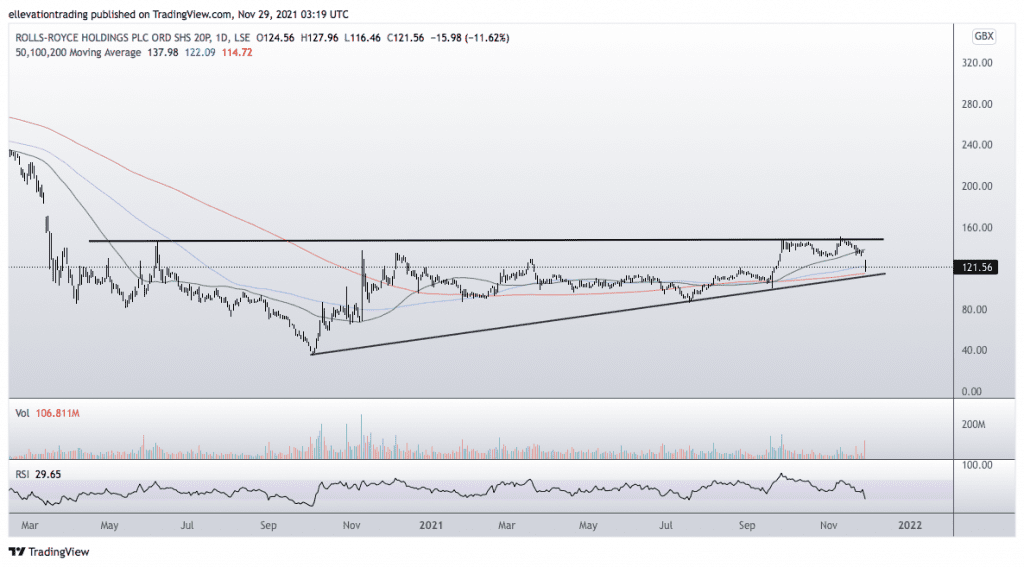

The daily chart shows the share price closed below the 100-DMA for the first time since September. However, RR remains above the significant 200-DMA at 11.72p, and a rising trend line at 112p. Furthermore, Friday’s sharp correction forced the Relative Strength Index (RSI) below 30.00, signalling, the downside move is technically overdone.

Considering the above factors, I expect the share price to open firmer on Monday as buyers take advantage of the discount window. On that basis I am friendly towards RR, with a medium-term target of $148p. However, a close below trend support at 112p, invalidates this thesis.

Rolls-Royce Share Price Chart (Daily)

For more market insights, follow Elliott on Twitter.