- Rolls-Royce share price is down by 29 percent this year. However, recent development may boost its recovery.

Rolls-Royce share prices have tanked throughout the year. The year-to-date data shows the company’s share prices have dropped by 29 per cent. However, since May 12, the prices have been in a long-term bullish trend, with the shares rising by 13 per cent to the current price of 88p.In today’s trading session, this bearish trend is poised to continue, with early morning hours showing a 1 per cent share price increase.

The price resurgence comes amidst a streak of positive reports, including a recent announcement by the Chief Executive Officer of Rolls-Royce, Warren East, that the first transatlantic flight powered solely by sustainable aviation fuel was likely to happen as soon as next year. The announcement could be a turning point in aviation’s quest to lower emissions for long-haul travel. The reports may also have boosted investors’ confidence in the company and likely contributed to today’s price gains in the market.

Rolls-Royce has also announced its Phantom model, which is due to be released in 2023. The much-anticipated luxury car will have updated themes and technology, and the car’s interior has continued to gain interest with car enthusiasts across the globe.

The company has also shown its commitment to electric car technology. In 2023, Rolls-Royce is expected to release its first electric car, called the Spectre. The company’s entrance into the electric vehicle industry is likely to boost its recovery and increase sales and revenues.

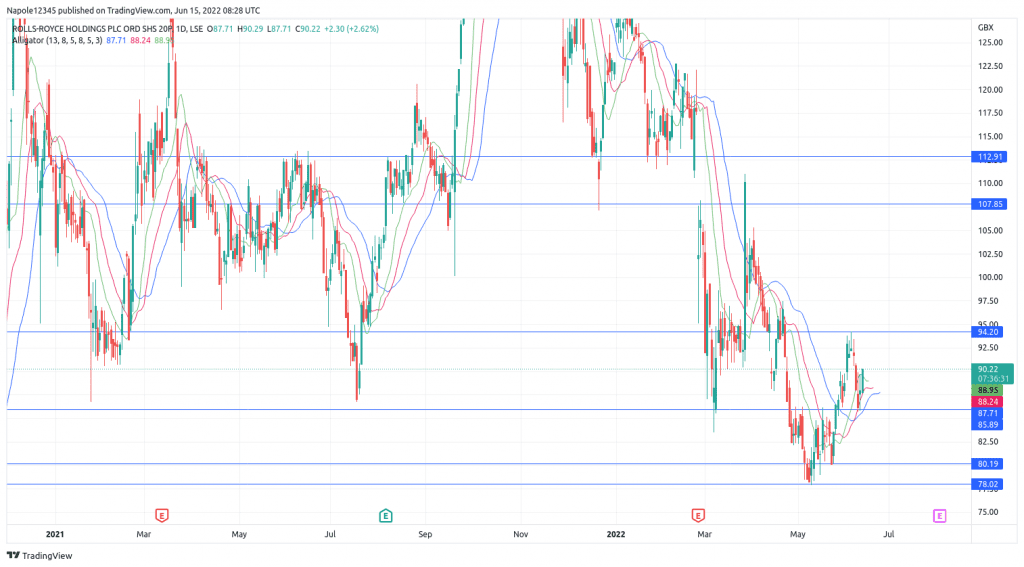

Rolls-Royce share price analysis

Rolls-Royce is up by a percentage point in today’s trading signal. The share prices also look poised to continue with the strong upward push throughout the session. The upward move is a continuation of a long-term bullish trend that started on May 12 and has seen prices rise by 13 per cent.

Using the chart below, I expect the prices to continue rising throughout the session and in the next few trading sessions. As a result, there is a high likelihood that we will see Rolls-Royce’s share price trade above 100p again. My bullish analysis will only be invalidated if the prices trade below the 80p price level. At that level, it will be clear that the prices have entered a bearish trend.

Rolls-Royce Daily Chart