- The Rolls Royce share price has made some gains in the past few days. Is Rolls-Royce stock price a good investment?

The Rolls Royce share price has made some gains in the past few days. It has risen in the past three straight days on the broad FTSE 100 recovery. The stock is trading at 86.91p, which was about 11.27% above the lowest level this month. However, the shares are still about 42% below the highest point in 2021, bringing the company’s market cap to over 9.16 billion pounds.

Rolls-Royce Holdings is a major company that is involved in key areas such as military power. And civil aviation. In defence, the company manufactures products like submarines, jets, and other naval products. The company manufactures jet engines used to make wide-body and business aircraft in its civil aviation business. It makes most of its money servicing these aircraft.

Rolls-Royce’s business is doing well as aviation demand bounces back. With more people flying, the number of flying hours is bound to increase. At the same time, the crisis in Ukraine has led to more business for defence contractors like Rolls-Royce and BAE Systems. However, the company has been seeing cost struggles as the prices of most items have jumped. At the same time, the ongoing lockdowns in China are holding back important service revenue. The firm said:

“Passenger demand is recovering on routes where travel restrictions have been lifted, such as in Europe and the Americas, but additional Covid-19 restrictions have resulted in fewer flights in China where the situation is still evolving.”

Rolls Royce, which became profitable in 2021, believes its profit margin will remain intact this year as sales growth is expected to grow by less than 10%. Still, the Rolls Royce share price will need a catalyst to bounce back.

Rolls Royce share price forecast

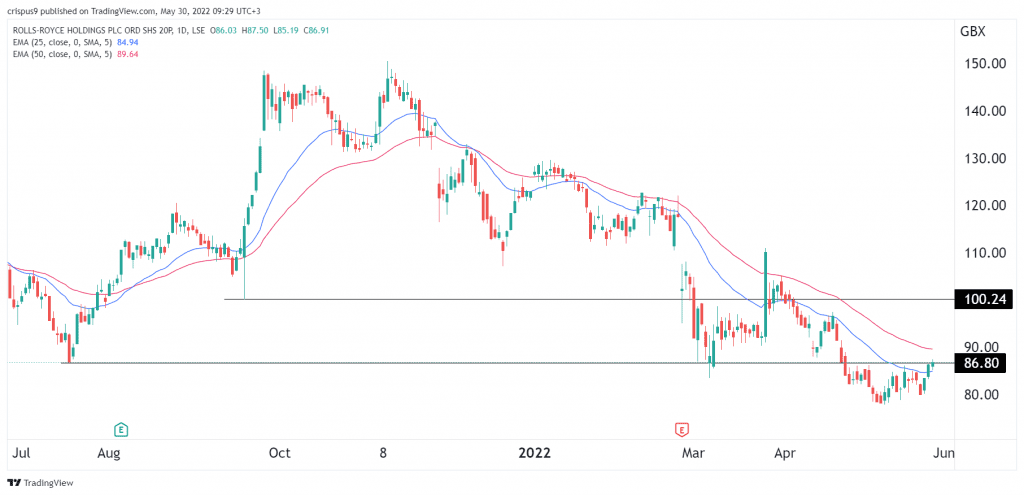

The daily chart shows that the Rolls Royce share price has made a strong recovery in the past few days. By so doing, the stock has retested the key resistance level at 86.80, which was the lowest level on 19th July. In addition, the shares have moved between the 25-day and 50-day moving averages. It is also below the important resistance level at 100p.

The RR share price has formed a break-and-retest pattern, meaning that the bearish trend is still intact. As such, there is a likelihood that the stock will retest the year-to-date low of 78.15. A move above the resistance at 95p will invalidate the bearish outlook.