- Summary:

- Rolls Royce share price declined sharply as the company asseses funding options. Is it now a buy at its 16 year low or can the stock continue falling

Rolls Royce share price is still in trouble. The stock is down by more than 1.45% today, underperforming the FTSE 100, which is down by just 0.85%. It is also trading at its lowest level since February 2004.

Rolls Royce has been an embattled company in the past few years. The company has spent millions of dollars repairing its Trent 1,000 engines that are used in many wide-body aircrafts. It has also suffered from lost sales after Airbus decided to do away with the Airbus A380 aircraft.

The coronavirus pandemic has had negative impacts on the iconic British company. It has slowed the airline industry leading to the collapse of several firms. Most of the airlines that have survived have done so because of government support.

For starters, Rolls Royce makes most of its money from the long-term contracts it receives from companies about servicing their engines. As an engine manufacturer, most airlines trust the company with these tasks. Also, most airlines receive the engines at a discount so that they can give Rolls Royce the service contract. Therefore, when airlines suffer, the company tends to suffer as well. The other business arms of Rolls Royce such as military contracts and other engines are relatively small to cushion the firm.

Rolls Royce stock has been under pressure

Indeed, because of these problems, Rolls Royce share price has fallen by more than 70% in the past five years and by 76% in the past 12 months. To be fair, General Electric (GE), its other major peer has also been in trouble, with the stock falling by 74% and 28% in the same period.

In a statement yesterday, the company announced that it was considering several financing options. But, it warned that it had not yet reached a final decision. Some of the options that are available are selling more shares, which will dilute the existing shareholders. It could also sell some of its assets. In the statement, it said that it had identified several assets worth more than £2 billion. The statement said:

“We have also announced GBP1 billion of cost mitigation activity in 2020 and launched a reorganisation of our Civil Aerospace business to save GBP1.3 billion annually. We have also identified a number of potential disposals that are expected to generate proceeds of more than GBP2 billion over the next 18 months, including ITP Aero.”

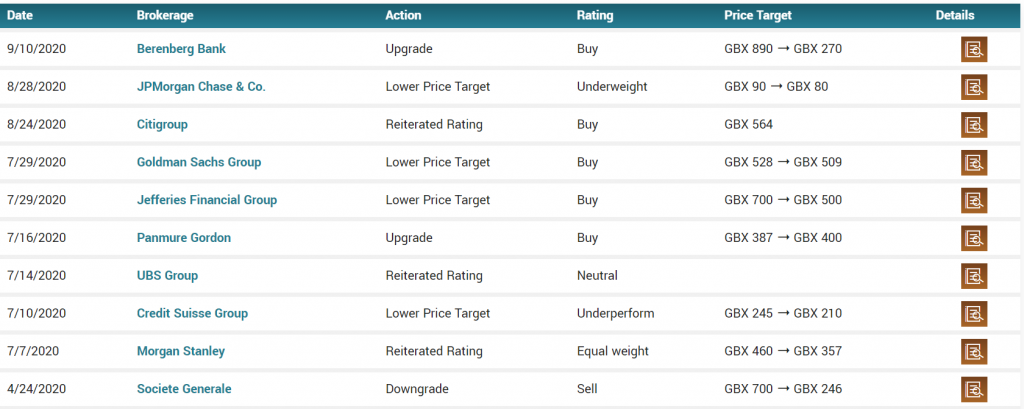

So, is Rolls Royce stock a buy? Analysts have mixed opinion about Rolls Royce stock price. Those at JP Morgan are extremely bearish and expect that the shares will drop to 80p. That is a decline of more than 90% from the current level. At the same time, Berenberg analysts expect the stock will rise to 270p while those at Citi, JP Morgan, and Jefferies expect it to rise to more than 500p.

Rolls Royce holdings analysts forecasts

Rolls Royce share price forecast

The weekly chart below shows that Rolls Royce stock price fell to a 2004 low of 185p. The price has been in the red in the past four consecutive weeks. Most importantly, it moved below the previous support at 212p and bears seem to be in total control. It is below all the short, medium, and longer-term moving averages while the RSI is in the overbought level.

Therefore, the path of least resistance, at least in the near term, seems lower. This means that the price is likely to continue falling as bears aim for the next support at 150p. On the flip side, a move above the important resistance at 300p will invalidate this trend.

Start your trading journey with our free forex trading course and one-on-one coaching by traders and analysts with decades of experience in the industry.

Rolls Royce stock analysis