- Summary:

- The Rolls-Royce share price is eerily calm as the airline earnings season kicks off. The RR stock is trading at 143p

The Rolls-Royce share price is eerily calm as the airline earnings season kicks off. The RR stock is trading at 143p, which is a few points below last week’s high of 148p. It has risen by more than 66% from its lowest level in July this year.

Airline earnings and key announcements

Rolls-Royce Holdings is one of the biggest aircraft engine manufacturers in the world. It competes with the likes of General Electric, Safran, and Pratt & Whitney. The company also makes money in military contracts and power sectors.

Therefore, the Rolls-Royce share price tends to react to the announcements by key airlines. In the coming weeks, many airlines will make some key announcements as they publish their quarterly results.

On Monday, Delta Airlines announced that it turned a profit again in the second quarter, a sign that the aviation sector is recovering. The company made more than $9.15 billion in the quarter, higher than the expected $8.4 billion. Other companies like United, American, and Southwest will publish their results next week.

While Delta had a strong quarter, it’s stock crashed by more than 5% after it warned about its profitability as the price of oil rises. Jet fuel price has jumped by more than 50% this year. This is notable since fuel is usually the most important costs of any airline.

Still, the strong revenue growth by Delta is a sign that Rolls-Royce will record higher flight hours in the third quarter. This is important because the company makes most of its money by servicing aircrafts that use its engines.

Meanwhile, the Rolls-Royce share price is also reacting to the recent deal between the UK, US, and Australia. The deal will see these countries develop nuclear-powered submarines. This deal could benefit Rolls-Royce, which is a major contractor. At the same time, the company received a major order for B-52 aircrafts from the American government.

Rolls-Royce share price forecast

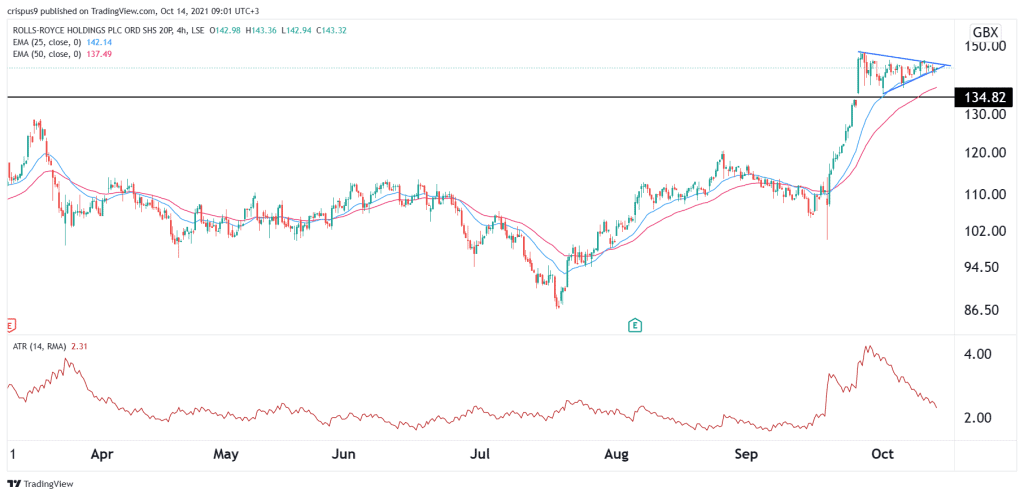

The four-hour chart shows that the RR has been in a tight range recently. The stock is slightly above the key support level at 134p, which was the previous year-to-date high. At the same time, it seems like it is forming a bullish pennant pattern. In price action analysis, a bullish pennant is usually a bullish sign. The stock is also being supported by the short and longer moving averages.

Therefore, there is a high likelihood that the shares will soon break out higher as bulls target the next key resistance at 180p. On the flip side, a drop below 134p will be a bearish signal.