- What is the forecast for the Rolls-Royce share price? We explain whether RR is a good investment in the long term.

The Rolls-Royce share price has crawled back in the past few days as investors cheer the strong travel comeback. The RR stock is also rising as the market reflects on the most recent trading statement and investor day event. It is trading at 83.85p, which is slightly above last week’s low of 78.06p. Still, the shares are about 45% below the highest point in 2021.

Rolls-Royce is a leading player in the aviation industry. The firm is well-known for its wide-body aircraft engines that it sells to leading aviation brands like British Airways, Etihad, and Emirates. It has a 58% market share in this industry. The company makes most of its money in long-term servicing contracts, meaning that its business is doing well as flying demand jumps.

Rolls-Royce delivered an upbeat message in its trading statement last week. The management said that its long-term service agreements rose by 42% from the same point in 2021. It also noted that passenger demand is recovering at a fast pace than expected. Also, its defence business is doing well as governments increase their spending. The same is true for its power business. However, like all industrial companies, Rolls-Royce is seeing higher costs across its business.

Rolls-Royce may be a good investment as investors rotate to value stocks as interest rates rise. Also, the company will likely benefit as the UK, and other governments boost their defence spending following Russia’s invasion of Ukraine.

Rolls-Royce share price forecast

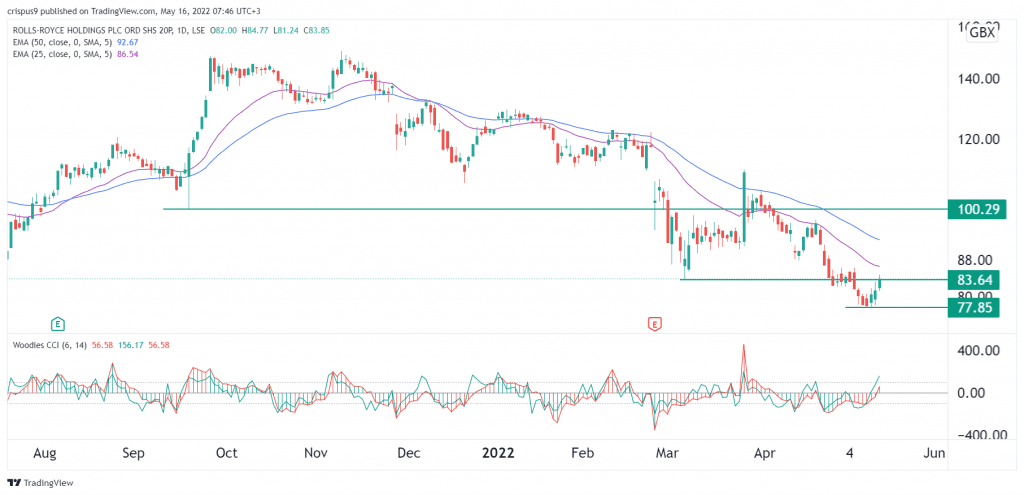

We see that the RR share price has been in a strong bearish trend in the past few days on the daily chart. The stock remains below the 25-day and 50-day moving averages. It has also retested the important support level at 83.64p, which was the lowest level on March 4th. At the same time, the Woodie CCI has moved slightly above the neutral level.

While the recent moves are positive, Rolls-Royce stock price will continue to be in a bearish trend as long as it is below the two moving averages. A break below the support at 77.85p will be a signal that bears have prevailed.