- Summary:

- The Rolls-Royce share price is in a consolidation phase as investors focus on the company’s cost of doing business.

The Rolls-Royce share price is in a consolidation phase as investors focus on the company’s cost of doing business. RR shares are trading at 84.20p, where it has been in the past few days. This price is about 45% below the highest point in 2021.

RR stock forecast according to analysts

Rolls-Royce Holdings is a giant British conglomerate that provides services to the government and the aviation industry. The firm is widely known for the wide-body aircraft engines it sells to airlines and manufacturers like Boeing and Airbus.

Rolls Royce and other industrial stocks like Caterpillar, Danaher, and Chart Industries have been under pressure. This performance is mostly because investors are worried about the soaring cost of doing business in most countries.

As a result, analysts have a varying outlook about the Rolls Royce share price. According to MarketBeat, the average estimate for the stock is 108p, which implies a 30% increase from the current level. However, this estimate should be taken with a grain of salt since it includes estimates that were made months ago.

The most recent estimates for the stock are from Deutsche Bank, Citigroup, and Berenberg; all these banks published their views this month. On Wednesday, Deutsche Bank reiterated its view about the stock. The analysts expect that the shares will rise to 95p in the near term.

The other estimate came from Citi. Its analysts are incredibly bullish on Rolls Royce stock as they expect it to rise to 147p. This means they expect it to rise by over 90%. Finally, those at Berenberg have a buy rating, although they reduced their estimate from 160p to 100p. In May, JP Morgan lowered their rating to 70p. Finally, as shown below, a DCF calculation by Simply Wall St estimates the company is 15% undervalued.

Rolls-Royce share price forecast

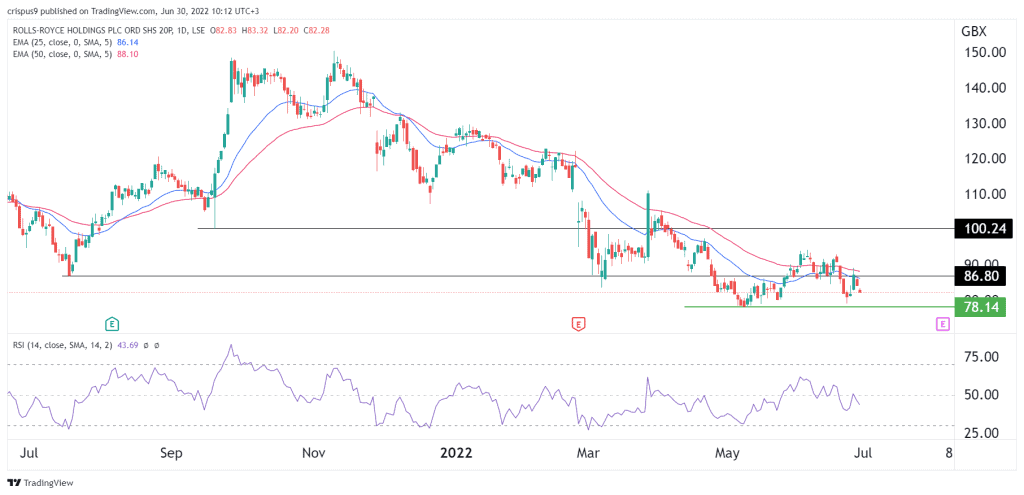

The daily chart shows that the RR stock price has been in a consolidation phase. The stock is hovering between the important support and resistance level at 78.14p and93p. In addition, it is trading slightly below the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has pointed downwards.

Therefore, the stock will likely continue fling as bears target the next key support level at 78.14. A drop below that level will signal that bears have prevailed and that they will start focusing at 70p. A move above the key resistance at 86.80 will invalidate the bearish view.