- Summary:

- Rolls Royce share price falls steeply as travel bans impede long-haul flights, increasing pressure on the company's aviation division.

A declaration by the UK Health Secretary on the “phenomenal” spread of the Omicron variant of COVID-19 has piled tons of pressure on stocks of companies operating in the aviation sector. Plane engine maker Rolls Royce is one of such stocks, as the Rolls Royce share price tumbled on Monday to the tune of 4.23%.

The slump in the Rolls Royce share price also comes as Nigeria, one of the countries targeted by a UK travel ban due to the the emergence of the variant has banned inbound flights from the UK, Canada and Saudi Arabia in what Nigeria’s aviation minister Hadi Sirika has termed a reciprocal action against the UK’s travel ban.

The reciprocal travel ban means that flights operated from London to Lagos on British Airways and Virgin Atlantic could now be impacted on Africa’s most lucrative route from London Heathrow airport. Rolls Royce is also planning to cut 8,500 jobs by year-end, which would be a dramatic end to another year where the COVID-19 pandemic has dominated headlines around the stock.

Rolls Royce Share Price Outlook

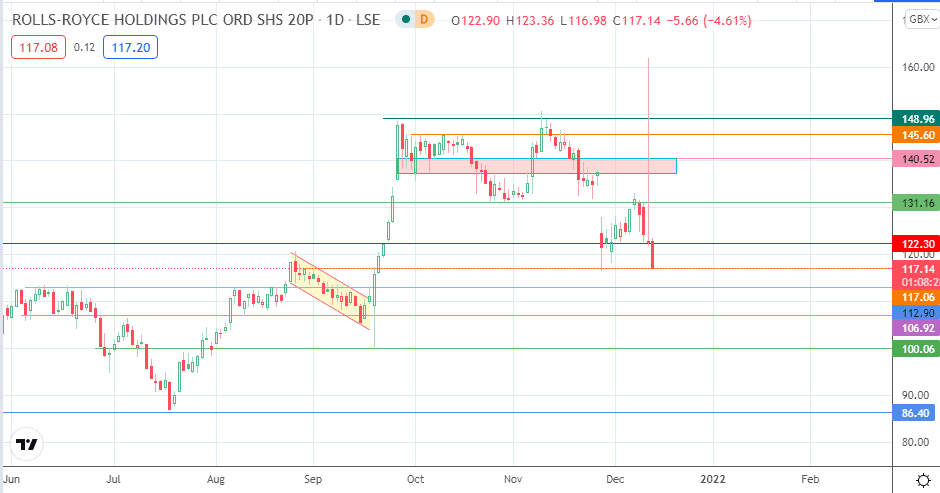

The intraday slump puts the bears in a position to challenge the 117.06 support. A breakdown of this level opens the door towards 112.90. This move leaves 106.92 and 100.06 as viable additional price targets to the south.

On the flip side, a bounce on 117.06 allows the bulls to target a recovery towards 122.30. 125.18 and 128.64 are additional price targets to the north. 134.94 and 140.52 only become viable targets if the advance is more extensive.

Rolls Royce: Daily Chart

Follow Eno on Twitter.