- Summary:

- The Rolls Royce share price is trending higher, but can it sustain the recent rally to 100p on the back of increased passenger travel?

The Rolls Royce share price continues its advance this Monday, notching up gains of 3.56% to end the stock above the 90p mark. This uptick puts the Rolls Royce share price second on the FTSE100’s top gainers for the day as of writing.

Fueling interest in the stock this Monday is the desire of traders to snap up the stock at perceived bargain prices ahead of the busy holiday season. Furthermore, traders are also positioning themselves in the stock as the Russia-Ukraine conflict forces an increase in defence spending by the UK and across Europe in response.

The company’s civil aviation division gets its revenue calculated based on the number of hours its engines operate. With the return of pent-up travel demand, these flying hours are up 42% over the previous year. As a result, the company has maintained its full-year guidance in its financial performance and end-market growth.

However, the recent rally could be capped as the demand rebound remains subject to macroeconomic uncertainties. Institutional analysts have set a Rolls Royce share price target of 126.80p, giving the stock a potential upside of 38.12%.

Rolls Royce Share Price Forecast

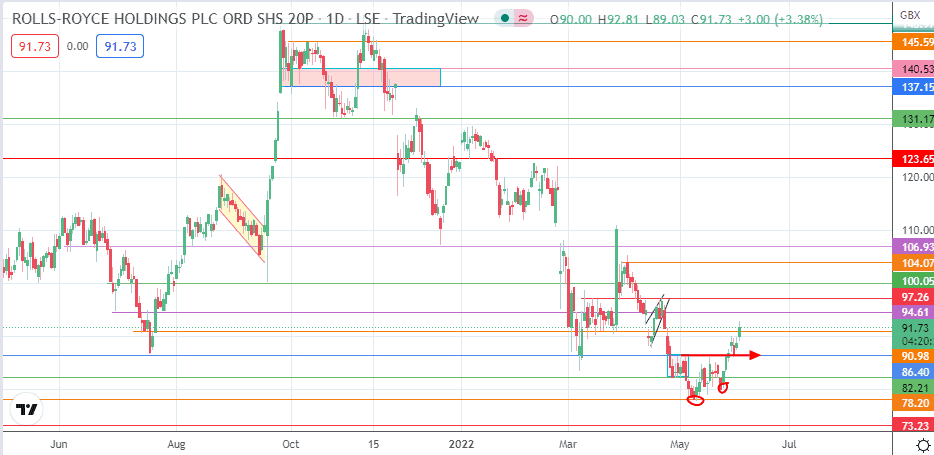

The measured move from the double bottom’s breakout continues, targeting completion at 94.61. If the advance continues beyond this barrier, the 21 April high at 97.26 becomes the new target. Above this level, additional price targets are seen at 100.05 (psychological resistance) and 104.07 (29 March low).

On the flip side, a decline below the current support at 90.98 could signal a resumption of the downtrend from the current retracement rally. This would see 86.40 (former ceiling of the rectangle pattern of 26 April to 6 May) and the 82.21 pivot (floor of rectangle) constitute the immediate downside targets following this break. 78.20 is the site of the 1st trough of the double bottom, and a breakdown of this level signals downtrend continuation. 73.23 would be the next southbound target.

RR.: Daily Chart