- Despite today’s trading session showing a strong Rolls-Royce share price rising, and extending yesterday’s 3 per cent gain.

Despite today’s trading session showing a strong Rolls-Royce share price rising, and extending yesterday’s 3 per cent gain, the company is still in the red for the year. The company’s year-to-date data shows it has lost a third of its value, and there is still a likelihood of dropping further down.

Rolls-Royce Current Financial Situation

The latest reports indicate that Rolls-Royce missed a target to complete the sale of ITP Aero last week. The deal, which is valued at £1.5billion, would have seen Rolls-Royce sell its Spanish division, and the money directed to shore up its finances. Currently, the company is in dire need of funds, and reports indicate the FTSE100 firm needs to sell at least £2 billion worth of its business.

The company has also struggled with rising oil prices and airport staffing problems, which have also hindered its recovery. Early on in the year, Rolls-Royce was looking highly likely to be among the best-performing companies. Investors were also positive that the lifting of the pandemic restrictions would also see the company return to pre-pandemic levels. However, going back to business as usual has not worked due to the current economic and political conditions.

The company is also facing a leadership vacuum, with its CEO expected to resign soon. Although the board, chaired by Anita Frew, continues to look for a replacement, investors’ confidence is shaky, which could also be impacting the current share performance.

However, despite the company facing issues, the growing military spending across Europe is likely to play a key role in the company’s recovery. Most countries have increased or are looking to increase their military budgets, which will see Rolls-Royce’s share price recover due to the company’s being a leader in the defence industry.

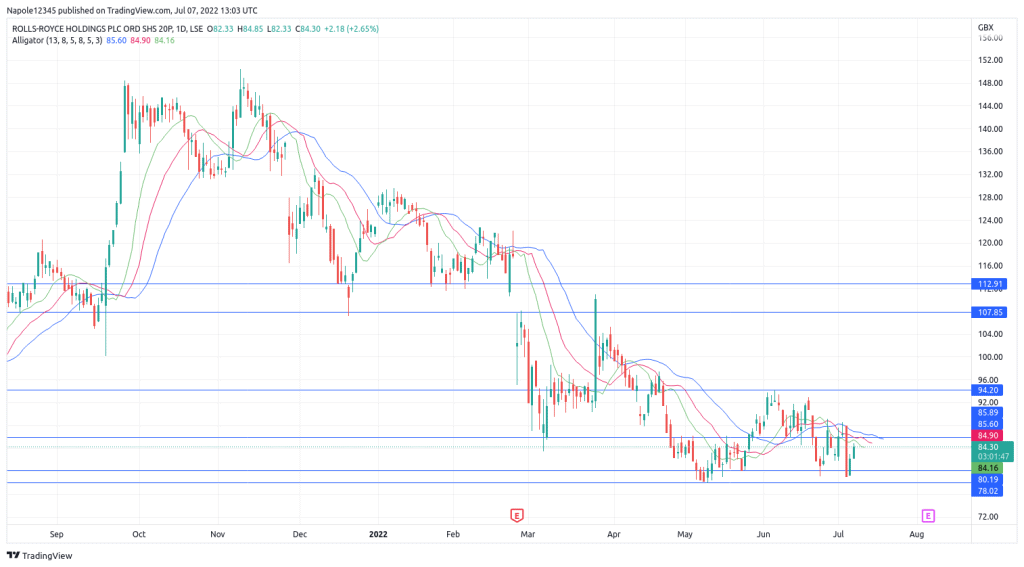

Rolls-Royce Share Price Prediction

As stated above, Rolls-Royce is in a critical position and the next few days may impact where the share prices finish in July. In my opinion, I expect the prices to recover, especially with the sale of one of its units looking likely to succeed.

There is a high likelihood that we will see Rolls-Royce trading above the 90p price level in the next few trading sessions. It is also possible that, in July, prices may push past 100. However, if the deal is botched or the CEO appointment is underwhelming, then my analysis will be invalidated.

Rolls-Royce Daily Chart