- The Rolls-Royce share price has struggled this week as concerns about the new wave of Covid-19 pandemic in the UK have risen.

The Rolls-Royce share price has struggled this week as concerns about the new wave of Covid-19 pandemic in the UK have risen. The RR share price has also lagged as more airlines have published relatively strong quarterly results.

Rolls Royce and new Covid wave

Rolls-Royce Holdings is a leading aircraft engine manufacturer. The company is best known for manufacturing engines used by large jets that move between continents. It is also a leading servicer of aircraft engines and manufacturer of military jet engines.

Therefore, the company’s share price has been in focus this week for two reasons. First, the Covid-19 pandemic has worsened in some countries like the United Kingdom. The number of hospitalizations, infections and even deaths have risen.

Therefore, there is a likelihood that the UK government will implement new lockdowns and implement more quarantine measures. These measures could affect the recovery of the aviation sector.

The Rolls Royce share price has also been watched because of the ongoing earnings season. Last week, Delta Airlines reported strong results. Similarly, other airlines reported strong results this week. United reported revenues of more than $7.75 billion, which was better than the expected $7.65 billion.

In another report, American Airlines announced that its revenue rose to $8.97 billion. Southwest also reported strong results for the quarter. These results show that the airline industry is recovering faster than expected.

However, all companies warned that the industry could suffer as the price of oil rose. Oil is usually the biggest cost that airlines face. Still, the fact that there is strong demand is a good thing for Rolls Royce.

Rolls-Royce share price

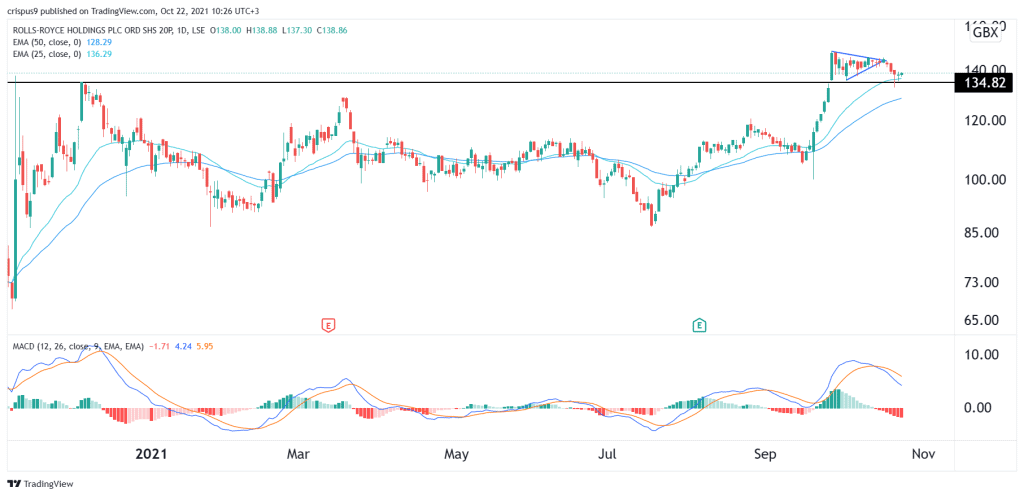

The daily chart shows that the Rolls-Royce share price formed a break and retest pattern. This happened as the stock moved to retest the key support level at 134p, which was the highest level in December last year.

The stock has also formed a bullish pennant pattern, which is usually a positive sign for the shares. It is also slightly above the 25-day and 50-day moving averages. Therefore, I suspect that the shares will resume the bullish trend as investors eye the key resistance level at 150p. This view will be invalidated if it drops below the support at 125p.