- Robinhood share price reacted to news of a buyout by surging by more than 14 percent in yesterday's trading session.

Reports of FTX’s consideration of buying Robinhood sent its shares flying during yesterday’s trading session. At one point, Robinhood’s share price was as high as 19 per cent. However, the late session hours saw the prices drop, and Robinhood’s share price closed the market with a 14 per cent gain.

FTX Robinhood Buyout

According to a report by Bloomberg, an unidentified source familiar with the matter indicated that Sam Bankman-Fried’s FTX crypto exchange was exploring the possibility of buying Robinhood. Although there has not been an official offer yet, Bloomberg indicated the matter was being seriously discussed.

On Monday, Bankman-Fried stated that they were excited about Robinhood’s business prospects and potential ways they could partner. However, he indicated that there had been no Mergers and acquisitions (M&A) conversations. Robinhood’s spokesperson also declined to comment on the matter, leaving investors to speculate on whether that was a possibility.

Since its initial public offering in July of last year, Robinhood has continuously struggled in the markets. This has seen its value decline by 75 per cent in less than a year, bringing its current market capitalization to $7.9 billion.

However, the acquisition of Robinhood could result in share prices starting to recover. A merger would also combine the two companies’ potential and see growth in both the cryptocurrency space and the stock trading space.

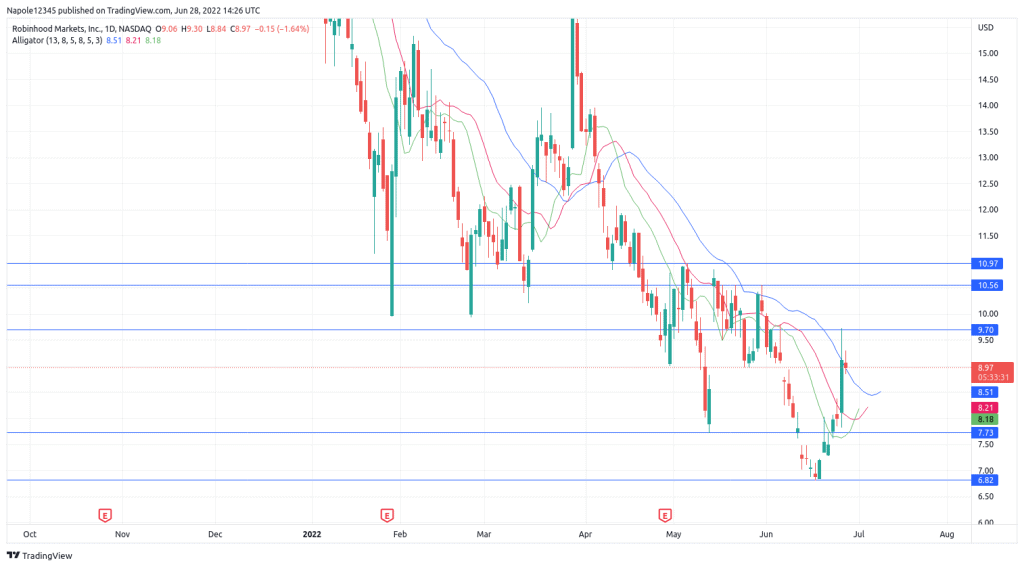

Robinhood Share Price Analysis

Recent reports of the acquisition will likely continue to dominate the news cycle for the next few trading sessions. If the reports are not denied or confirmed, there is a high likelihood of investors expecting an acquisition, which will see them also investing in the project and cause prices to go up.

Confirmation of the reports will also likely see the prices go up, with denial having little to no impact. Therefore, my Robinhood take for the next few trading sessions expects the prices to go up based on the current underlying fundamental factors.

RobinHood Daily Chart