- Summary:

- The Rivian share price has dropped like a rock in the past few months. We explain what to expect in the near term.

The Rivian share price has had a classic fall from grace situation in the past few months. The RIVN stock fell to an all-time low of $33.24, bringing its total market capitalization to below $40 billion for the first time. It is now trading at $46.55, which is still dramatically below its all-time high of $180. Other EV stocks like Nio, Li Auto, and Xpeng have also crashed in the past few months.

Why RIVN is in trouble

There are several reasons why the Rivian stock price has crashed hard in the past few months. First, competition in the electric truck industry is heating up as companies like General Motors and Ford prepare their launches. The two Detroit giants have announced monster reservations for its key trucks. For example, GM Silverado has over 110k reservations while Ford’s F150 has over 200k reservations. As a result, the company decided to stop new bookings.

Second, Rivian is seeing a sharp increase in costs as commodity prices rise like all companies in the industry. The most notable one is nickel, whose price has more than doubled because of the crisis in Ukraine. In addition, other metals used to manufacture vehicles like steel and aluminium have also dramatically increased prices. As a result, the company has resulted to jerk prices, which has led to order cancellations.

Further, the company has disappointed investors in the past few months. For example, in its most recent earnings report, Rivian downgraded its production target. As a result, analysts from banks like Mizuho, Deutsche Bank, and Piper Sandler also decided to downgrade their price target.

In a statement, Dan Ives of Wedbush said: “We believe Rivian from a core engineering and design perspective along with the Amazon commercial relationship has potential to be a major EV stalwart over the next decade. However, for that to happen they need to start delivery models to customers and stop the excuses.”

Most importantly, the Rivian share price has struggled because of valuation concerns. The company is still valued at over $40 billion while Ford has a market cap of $68 billion. The latter sells millions of cars every year and has an excellent lineup of EV cars.

Rivian share price forecast

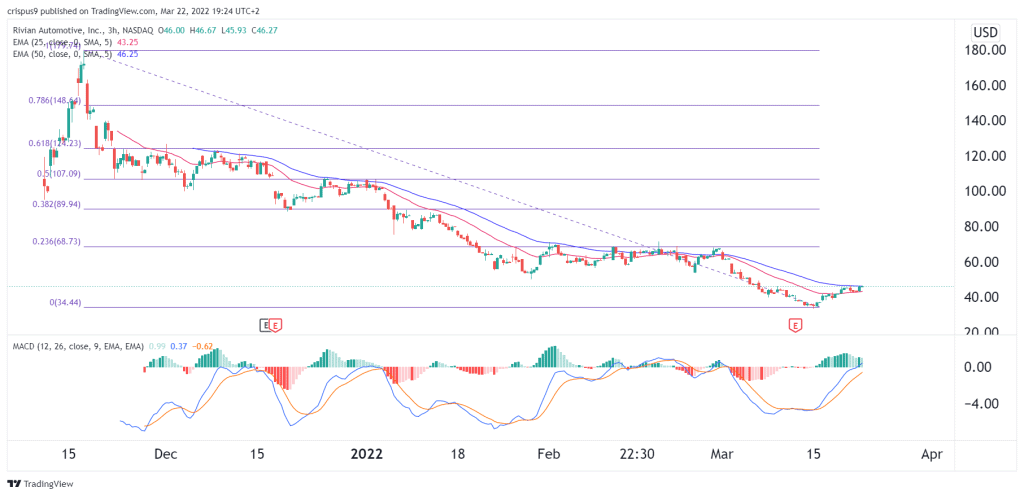

The three-hour chart shows that the Rivian stock price has dropped like a rock in the past few days. It is now attempting to crawl back, but it remains below the 23.6% Fibonacci retracement level. In addition, the 25-period and 50-period moving averages have flattened. Therefore, with the Fed turning more aggressive, there is a likelihood that the RIVN share price will continue moving in a downward trend in the near term. If this happens, the next key support level will be at $35.