- Summary:

- US-China trade war is reignited after China accuse the US of reneging on an agreement to postpone the implementation of the tariffs on Chinese electronics.

The risk-on sentiment which hit the market after the agreement in principle to postpone the tariff regime on electronic components from China seems to have worn off Thursday as China has accused the US of reneging on the agreement with a new 10% tariff.

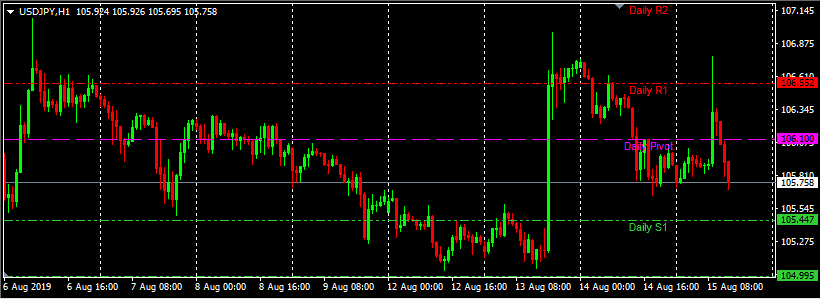

Gold is starting to receive safe-haven demand bids after the latest comments from China re-ignited the US-China trade war and set the markets once more in a risk-off mode. Gold briefly touched off the $1530 mark before pulling back slightly to $1520. The US Treasuries are also benefitting from the risk-off sentiment, as the 30-year Treasury has regained the 2% mark, having experienced a record fall below 2% in the previous trading session. Crude oil is also sharply lower from the highs of Tuesday’s New York session and is trading at just above the $54 mark. The Japanese Yen and the Swiss Franc are also gaining broadly, with the USDJPY falling nearly 100 pips from today’s highs at 106.70.

The focus for traders as the New York session draws is the US Retail Sales and the Philly Fed Manufacturing Index. The markets are expecting the Core Retail Sales to remain stagnant at 0.4% while the Manufacturing Index of the Federal Reserve Bank of Philadelphia is expected to show contraction in manufacturing.