- Summary:

- The US Government has delayed the proposed ban on Huawei from US equipment purchases by 90 days, boosting risk-on sentiment.

A Reuters report monitored a short while go confirms that US Commerce Secretary Wilbur Ross has announced that the United States will be delaying by 90 days, the ban on Huawei’s purchases from US companies. Consequently, an additional 46 subsidiary entities of Huawei will be included in the entity list. This decision may not be unconnected with an ongoing lobby by the US companies who would have been adversely affected by the ban.

The remark by the US Commerce Secretary look set to reinforce the risk-on sentiment with which the trading week has begun. As a result, gold has dropped below the $1,500 mark to trade at 1497.81.

It remains to be seen whether the risk-on sentiment will eventually dominate this week’s trading sessions, as the latest CFTC positioning report indicates that the sentiment of positions still remains decidedly risk-averse.

The Japanese Yen remains under pressure in its pairings with the US Dollar, Euro and British Pound. The Euro has found some strength on the day from the comments of German Finance Minister Olaf Scholz, in which he indicated that Germany would be prepared to spend an extra 50 billion Euros in stimulus spending in order to counter any future economic crisis.

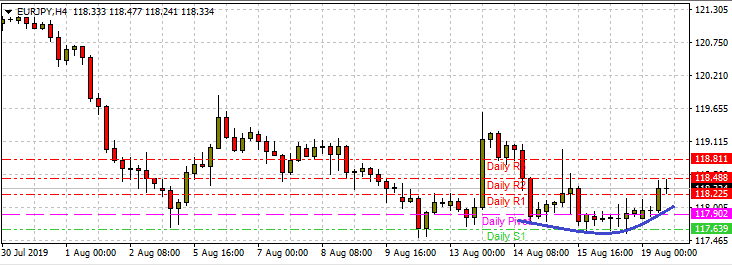

The EURJPY is presently trading at 118.33, having tested the 118.50 mark (R1 pivot). A break above this level will bring 118.81 into focus. However, a downside break of 118.22 will see the EURJPY make a dash for 117.90. Bias for the EURJPY on the day is bullish, and a firm bounce off the rounding bottom at 117.90 could be a good template for buying on the dip.