- Summary:

- Turkey's unemployment rate rises and retail sales data disappoint, sending the USDTRY surging in Monday trading. USDTRY testing intraday resistance levels.

The USDTRY is up in Monday trading as Turkey’s unemployment rate climbed to 13% in June, up from the 10.2% that was recorded at the same time in 2018. The worsening unemployment figure came on the back of last week’s aggressive rate cut by the CBRT, the second such rate cut in succession that many analysts see as more of an attempt to dance to the tune of the central government than to stimulate growth in the local economy.

The Turkish Lira plunged on the back of this news to further extend losses that had occurred in the last trading session. The inability of the Turkish Lira to hold on to the gains it made following last week’s rate cut were further compounded by retail trade data that showed an annualized drop of 3.7%, after the June figure was revised downward by nearly 1%. Retail sales also showed a 1.5% decrease in July, which was worse than the previous figure of + 2.6% for June.

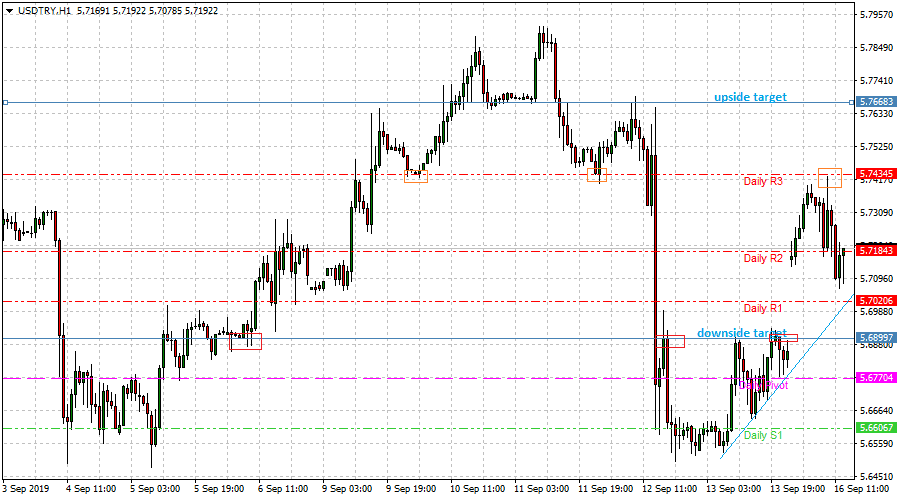

USD/TRY has pulled back from the intraday high of 5.7434 (R3 pivot) and is currently trading at 5.7136 (R2 pivot), which is the site of the R1.

Technical Play for the Day

Having pulled back from the R3 pivot and broken R2 to the downside, USDTRY is now pushing up once more to challenge the R2 pivot located at 5.7184. In the near term, a break of R2 will open the door for a further intraday retest of R3 at 5.74345 (intraday lows of September 10 and 12 in role reversal). Above R3, 5.76682 is a further upside target.

On the flip side, if price fails to break the R2 pivot, this may provide some strength for the TRY, taking USDTRY to 5.7020 (Sep 6 low) and below this level, 5.6899.