- Summary:

- Concens over global growth, increase in OPEC output and US-China trade war are weighing on WTI crude oil prices this Tuesday.

The WTI crude oil contract sold off on Tuesday due to the continuing US-China trade conflict and rising output from the oil cartel OPEC. Prices were also weighed down by an ever-strengthening US-Dollar index.

The WTI crude oil futures on NYMEX entered a 3-day losing streak as it just barely hangs on to the $54 mark, and is still facing a lot of downward pressure. The US-China trade war continues to be an important economic indicator which has raised concerns over global economic growth. Typically, concerns over global economic slowdown have been recurrent in the last two months and these typically could lead to a weakening of oil demand and a drop in prices.

Oil prices are also being pressured by the latest data from OPEC which indicates that production levels are starting to rise again after months of cutbacks. The next economic indicator to watch for will be the release of the EIA US crude inventory data at 1430 GMT on Wednesday September 3.

Technical Play for Crude Oil

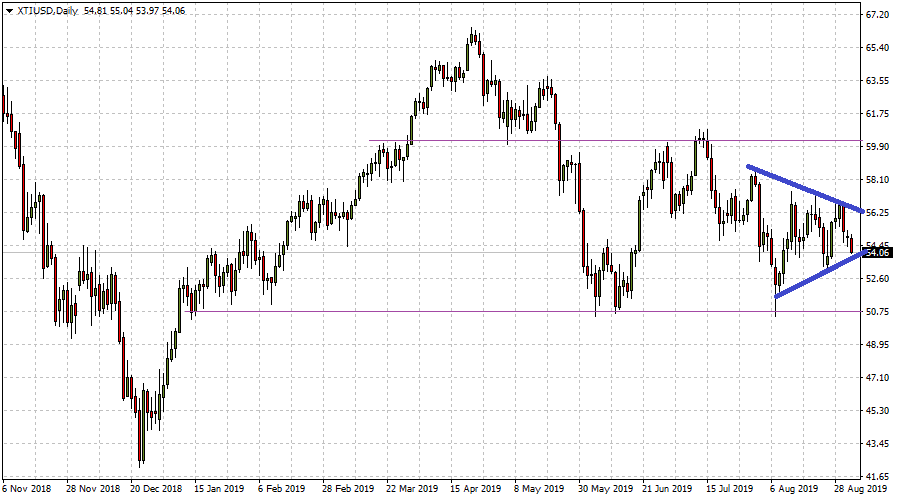

The daily chart shows that price action has begun to narrow within the confines of the symmetrical triangle. Below the triangle, medium-term support lies at 50.75. However, immediate near-term support for crude oil lies at 53.94 and 53.52.

The medium-term resistance lies around the $60 mark, while near-term resistance lies at 54.40 and 54.82 respectively. A break of the triangle border to the downside will bring the medium term support into focus, which then invalidates an upside recovery.

On the other hand, fresh headlines that boost crude oil prices will take it above the triangle’s upper border and then bring the medium-term resistance levels into focus, invalidating a downside break scenario.