- Summary:

- The boost in crude oil prices to 7-year highs has been good for the Royal Dutch Shell share price activity.

- Royal Dutch Shell price trades higher on rising crude oil prices.

- Evolving bullish flag points to further upside.

- RDS set to post a fourth month of gains in five.

The Royal Dutch Shell is back on the winning side following Friday’s correction. This move follows the rise in crude oil prices on Monday to 7-year highs on soaring demand.

Crude oil prices hit multi-year highs on Monday as large consumers shift their energy base from natural gas and coal to oil-based derivatives amid rising prices.

According to the AA, prices of petrol in the UK have soared, hitting a record high of 142.94p a litre on Monday. The UK-based Petroleum Retailers Association had warned of the increases, as fuel costs rose 50% from January till date.

However, the rising prices have enabled crude oil stocks such as Royal Dutch Shell to recover from a damaging pandemic-driven collapse in oil prices.

Royal Dutch Shell Share Price Outlook

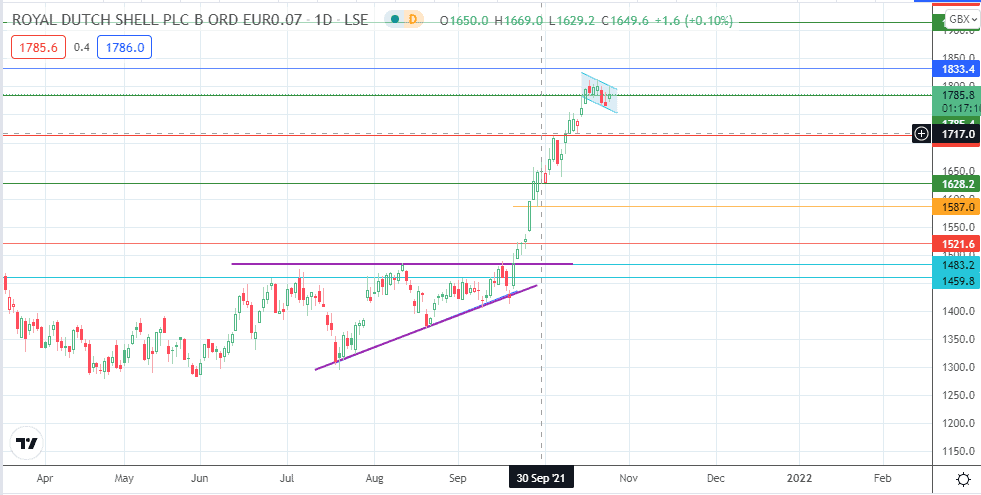

The slight consolidative decline following the measured move from the ascending triangle forms a potential bullish flag. A closing penetration of 3% above the 1785.4 resistance is needed to complete the pattern. This clearance opens the door towards the 1960.0 price target as the potential completion point of the measured move. The move’s completion is contingent upon the bulls taking out 1833.4 and 1914.6.

On the other hand, a breakdown of the flag’s lower border targets 1713.4. If the decline continues, 1628.2 becomes the next target in a move that invalidates the pattern. 1587.0 and 1521.6 may also become new targets to the south if the decline is extensive.

RDS Price: Daily Chart

Follow Eno on Twitter.