- Summary:

- Rio Tinto share price has been on an uptrend for about four months amid the expected rebound in China's steel industry.

Table of Contents

Rio Tinto Plc. (NYSE: RIO) is an Anglo-Australian company in the metal and mining industry; Rio Tinto is the second-largest globally after BHP. It is listed on the Australian Securities Exchange (ASX) and London Stock Exchange. Besides, its British’s American Depositary Shares are traded on the New York Stock Exchange (NYSE). Amid the positive outlook of the industrial metals’ sector, this article will focus on the Rio Tinto share price and the viability of the stock as a short and long-term investment.

Table of contents

Rio Tinto News

As with other stocks and financial assets, fundamental analysis is crucial in conducting a viable Rio Tinto share price forecast. Seeing that the company is a leading producer of iron ore, copper, and other industrial metals, its stock is largely impacted by the prices of these commodities.

In the last half of 2021, the decline in iron ore prices pushed the firm’s share price to a one-year low of $59.59. However, in the current year, analysts expect the steel industry to rebound, an aspect that will likely boost the firm’s profitability. According to ANZ Research, China’s steel production to surge by 5% in the current year.

Besides, based on the positive half-year earnings report, the FY21 results expected in the current week will likely be strong. The half-year results presented a 262% rise in dividends to $5.61 per share. Besides, its free cash flow surged by 262% to $10.2 billion.

Rio Tinto Stock: Is it a Buy, Hold, or Sell?

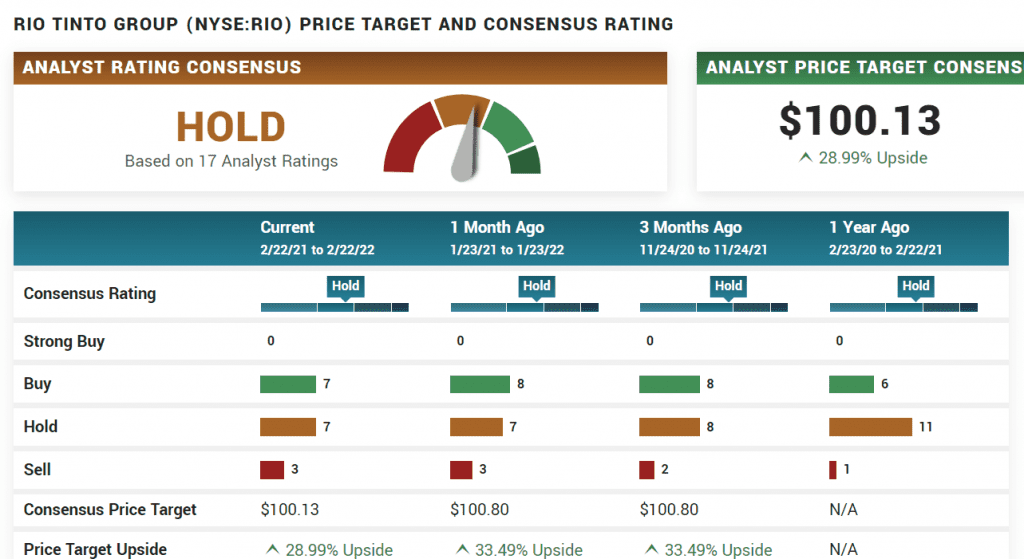

According to the 17 analyst ratings presented on Market Beat, the stock is a ‘hold’. In addition, the consensus is for Rio Tinto’s stock price to hit $100.13, which represents a move of 28.99% to the upside.

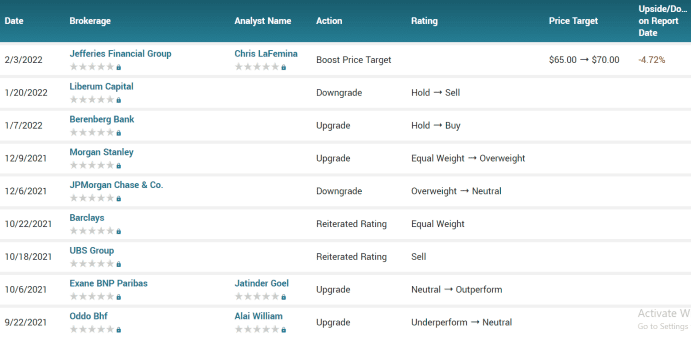

Notably, the analysts’ views regarding the company’s share price movements is rather mixed. On the one hand, Morgan Stanley has upgraded its position from ‘equal weight’ to ‘overweight’. On the other hand, JP Morgan has downgraded from ‘overweight’ to ‘neutral’. On the same note, Barclays has reiterated that Rio Tinto’s share price is at a ‘’equal weight’ rating.

Rio Tinto Share Price Short-Term Outlook

Rio Tinto stock price is trading above the 25 and 50-day exponential moving averages on a four-hour chart. While these technical indicators signal further gains in the coming days, especially with the expected release of its 2021 financial year results on Wednesday, its upward potential will likely be curbed in the short term.

In the ensuing sessions, the range between the 25-day EMA at 77.19 and the resistance level of 78.76 will be worth looking out for. If the earnings report misses analysts’ estimates, its stock price may drop to the 50-day EMA at $76.04. On the flip side, bullish figures may give yield an opportunity to retest the 6-month high of $80.43.

Rio Tinto Share Price Forecast for 2022-2025

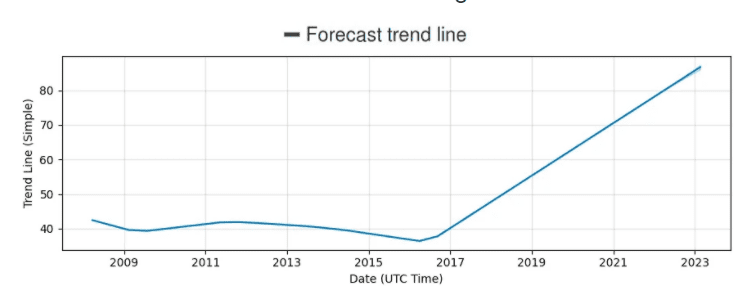

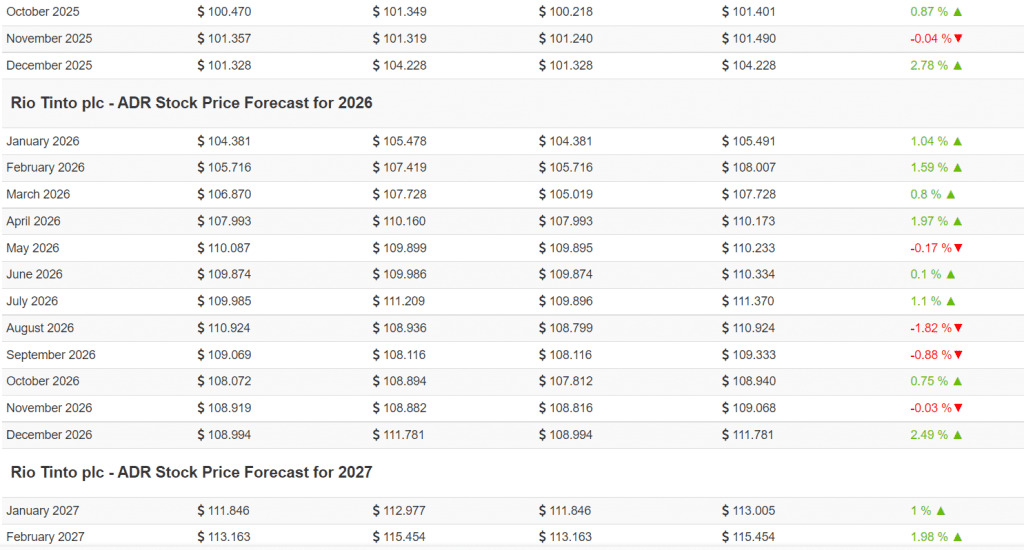

As observed in the graph below, Wallet Investor expects the Rio Tinto share price to increase significantly in the coming years.

The firm’s forecast is for the stock to hit $100 by the first quarter of 2025. By the end of 2025, it expects the share price to be $104.22. Five years from now, it predicts it to reach a high of $115.45.

While the Rio Tinto share price forecast is viable, it is important to note that analysts can get it wrong. Therefore, it is important to conduct detailed research before investing in the stock or other financial asset. This includes evaluating the influential market conditions and the company’s overall health and economy. In addition, markets are usually volatile, and trends can change within a short timeframe. Based on these factors, it is helpful to consider your risk tolerance.