- Summary:

- The Rio Tinto share price fell 2.8% on Wednesday after the company said its profits fell by 28% in H1 2022.

The Rio Tinto share price dipped by 2.82% this Wednesday after the company reported disappointing earnings results. Rio Tinto saw a 28% drop in its H1 2022 profit as inflation. Higher energy costs and weaker commodity prices impacted the company’s finances.

The Rio Tinto share price fell after the company announced earnings of $5.469 per share for the six months ended 30 June, a shortfall from the $7.561 per share it earned in the same period a year earlier. Revenue from sales also fell from $33.08 billion to $29.78 billion.

Weaker demand from China, the world’s top iron ore consumer, has combined with higher costs of energy products and staff shortages to deliver an earnings shortfall. China’s zero-COVID policy has been hugely responsible, as the policy mandates large-scale lockdowns for detecting even just a few cases of the virus.

This has led to a drop in industrial output, requiring less raw materials than would have been the case. Lower prices of iron ore have resulted, coming off 2021 highs and look set to remain softer in the medium term.

The company also announced that it would cut dividend payments by 52% and as expected, investors were not pleased. The Rio Tinto share price was down nearly 3.5% at a point in Wednesday’s trading, but some profit-taking by short sellers has allowed for a measure of recovery on the stock. The company also lowered its forecast for capital investments in 2022 by $500m.

Rio Tinto Share Price Forecast

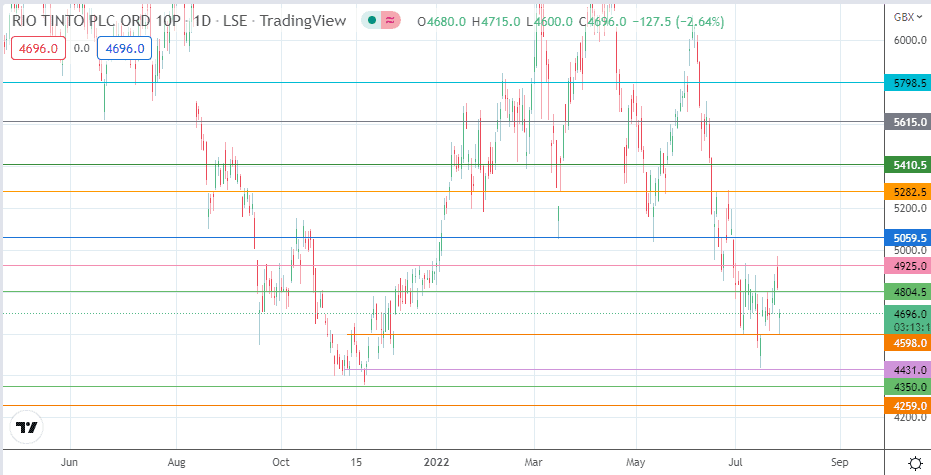

The steep intraday decline is testing support at the 4598.0 support level. A breakdown of this price mark gives the bears access to the 4431.0 support level, where the previous low of 9 November 2021 is located. This low is just below the 15 July candle low. If the bulls fail to defend this price mark, 4350 becomes another downside target (18 November 2021 low). 4259.0 (29 October 2020 low) is another price target to the south for the bulls.

On the other hand, a bounce from the 4598.0 support level allows for a recovery toward 4804.5 (20 July high). The bulls must overcome this barrier to continue the march northwards, targeting 4925.0 (7 July high) and 5059.5 (15 March low) along the way. An additional target is seen at 5282.5, the site of the 28 June high.

Rio: Daily Chart